The China Signal - April 2

State Grid approved for Naturgy takeover, China's foreign loan contracts, vaccine diplomacy

G’day, and welcome to The China Signal! This week, Chile’s competition regulator approves State Grid’s takeover of Naturgy, a new report on China’s unusual foreign lending stipulations, political exchanges, and yet more vaccine diplomacy. Read on.

Welcome to my new readers. It has been terrific to talk and present some of my analysis to you recently.

Deals and Investments

Chile 🇨🇱

Chile regulator approves $3 billion Chinese takeover of Naturgy unit | Reuters - March 31, 2021

Chile’s competition regulator on Wednesday approved a $3 billion takeover by China’s State Grid International Development of Spanish power company Naturgy’s Chilean unit Compania General de Electricidad (CGE).

Spain’s Naturgy said last November it had agreed to sell 96% of Chilean unit CGE to China’s State Grid for 2.57 billion euros ($3 billion), amid rising investment from the world’s second largest economy in South America.

Chile’s Fiscalía Nacional Económica (FNE), the country’s antitrust authority, said in a statement that it had given its unconditional approval for the deal, saying that it did not substantially affect competition in the power sector.

As first mentioned in TCS December 4, this gives State Grid 96% control of CGE, and combined with their ownership of Chilquinta, control over 57% of Chile’s power distribution network. The announcement has sparked debate in Chile, which does not have laws to review foreign investment on national security grounds, only with respect to market competition.

Broader Latin America 🏔🏝

This paper is the first systematic analysis of the legal terms of China’s foreign lending. We collect and analyze 100 contracts between Chinese state-owned entities and government borrowers in 24 developing countries in Africa, Asia, Eastern Europe, Latin America, and Oceania, and compare them with those of other bilateral, multilateral, and commercial creditors.

Three main insights emerge.

First, the Chinese contracts contain unusual confidentiality clauses that bar borrowers from revealing the terms or even the existence of the debt.

Second, Chinese lenders seek advantage over other creditors, using collateral arrangements such as lender-controlled revenue accounts and promises to keep the debt out of collective restructuring (“no Paris Club” clauses).

Third, cancellation, acceleration, and stabilization clauses in Chinese contracts potentially allow the lenders to influence debtors’ domestic and foreign policies.

Even if these terms were unenforceable in court, the mix of confidentiality, seniority, and policy influence could limit the sovereign debtor’s crisis management options and complicate debt renegotiation.

For example, China Development Bank (CDB) treats termination of diplomatic relations with China as an “event of default”.

Guyana 🇬🇾

US$25M Chinese seafood company creates 240 local jobs - Guyana Chronicle - March 23, 2021

GUYANA’S aquaculture sector has been boosted by a US$25 million investment from a renowned Chinese fish processing company, Grandeast Seafood Inc., which has constructed a facility at Garden of Eden on the East Bank of Demerara (EBD) and created employment for 240 persons.

The Chinese-owned company is a subsidiary of Hong Dong Fisheries Co., Ltd., a company headquartered in China which specialises in processing and trading of fishery products.

The company has already been issued a certificate of approval for operation, a certificate of inspection, and permanent national registration number by the Ministry of Health, and will soon begin exporting processed seafood products to China.

This system also allows for a processing capacity of 3,000 tonnes per year…

As of 2019, only 1% of Guyana’s exports went to China at a value of USD $41.7 million. Of this, only 11% of Guyana’s China exports were seafood, at a value of USD $4.5 million. In this context, a $25 million investment is sizable.

Diplomacy

The two items below are an example of political exchanges between Beijing and Latin American politicians in an effort to forge stronger political ties in the region. I covered this theme in more detail in TCS February 19.

Brazil 🇧🇷

China, Brazil pledge to strengthen bilateral ties - China.org.cn - March 26, 2021

*China.org.cn is a state-backed media outlet.

China's top legislator Li Zhanshu held talks with Arthur Lira, president of Brazil's Chamber of Deputies, via video link on Friday, vowing to deepen exchanges between the two legislative bodies in a bid to cement bilateral ties.

Li, chairman of the National People's Congress (NPC) Standing Committee, said China has always viewed and developed its relations with Brazil from a strategic and long-term perspective, attaching priority to China-Brazil diplomatic relations.

Chile 🇨🇱

“Ambassador Niu Qingbao meets with Chile’s Foreign Relations Committee of the Chilean Chamber of Deputies”

~Paraphrased translation~

On March 23, Ambassador Niu Qingbao held a videoconference with the Foreign Relations Committee of the Chilean Chamber of Deputies to exchange views on China-Chile relations, and economic, commercial, cultural, inter-parliamentary, and anti-epidemic cooperation.

El 23 de marzo, el Embajador Niu Qingbao realizó una videoconferencia con la Comisión de Relaciones Exteriores de la Cámara de Diputados de Chile para intercambiar puntos de vista sobre las relaciones China-Chile y la cooperación económica, comercial, cultural, interparlamentaria, antiepidémica y de otros terrenos.

Vaccine Diplomacy

Chile 🇨🇱

Chile’s president Sebastian Piñera said on Tuesday that his government had signed a new deal with CanSino Biologics for its one-dose coronavirus vaccine as the South American nation vaults ahead with one of the world’s fastest inoculation drives.

Piñera said in a televised statement that Cansino had agreed to deliver 1.8 million doses of the vaccine in May and June.

The latest deal assures the small but comparatively wealthy Latin American nation more than 35 million vaccination doses for 2021, enough to immunize 18 million people, Piñera said. More than 13 million shots have already been delivered, according to an official tabulation.

Chile moved fast and early to secure vaccines, signing deals with China´s Sinovac Biotech, U.S. drugmaker Pfizer Inc and the Britain-based AstraZeneca Plc.

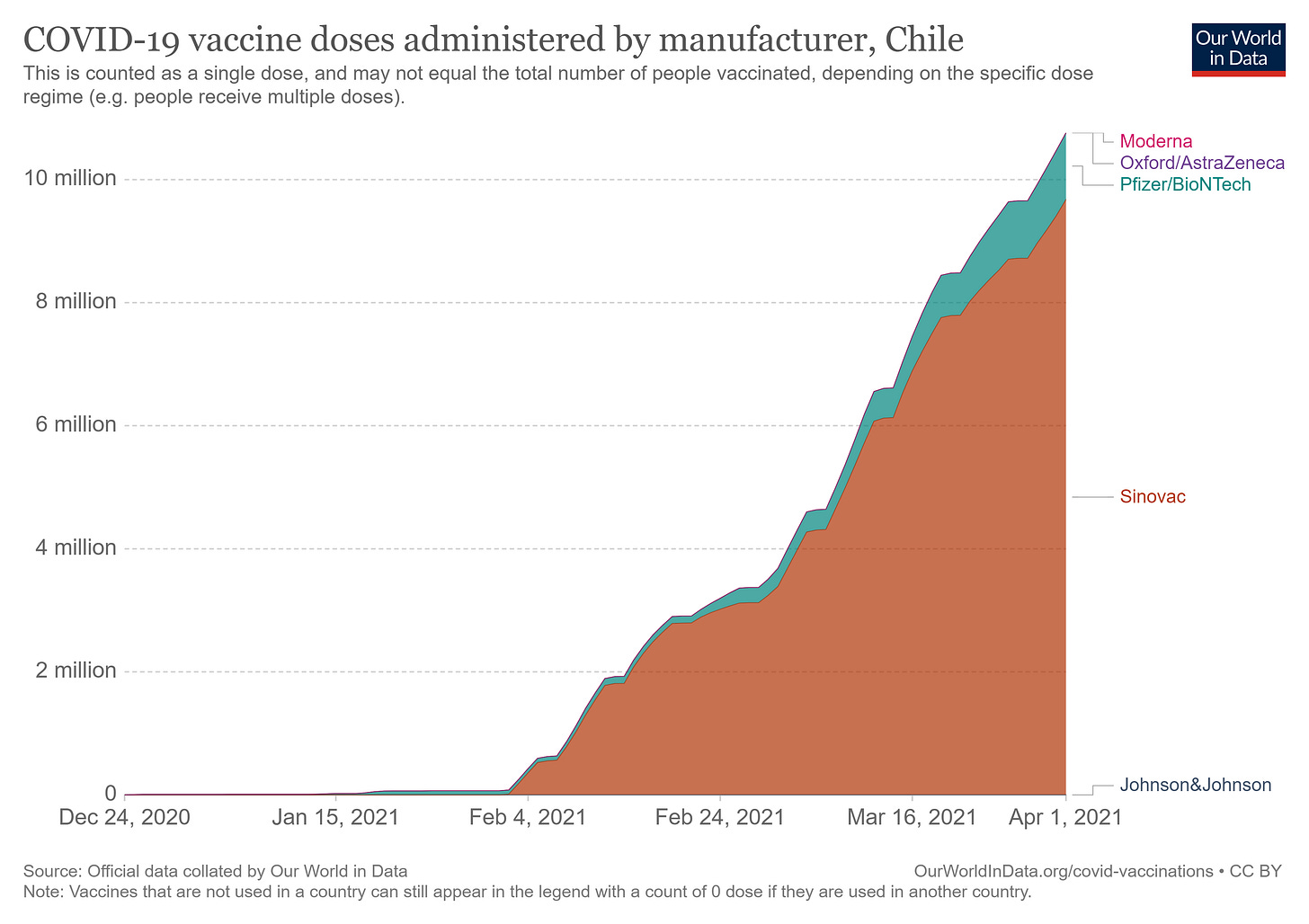

As of April 1, Sinovac accounts for approximately 90% of Chile’s vaccine doses administered, although the proportion of Pfizer doses is growing.

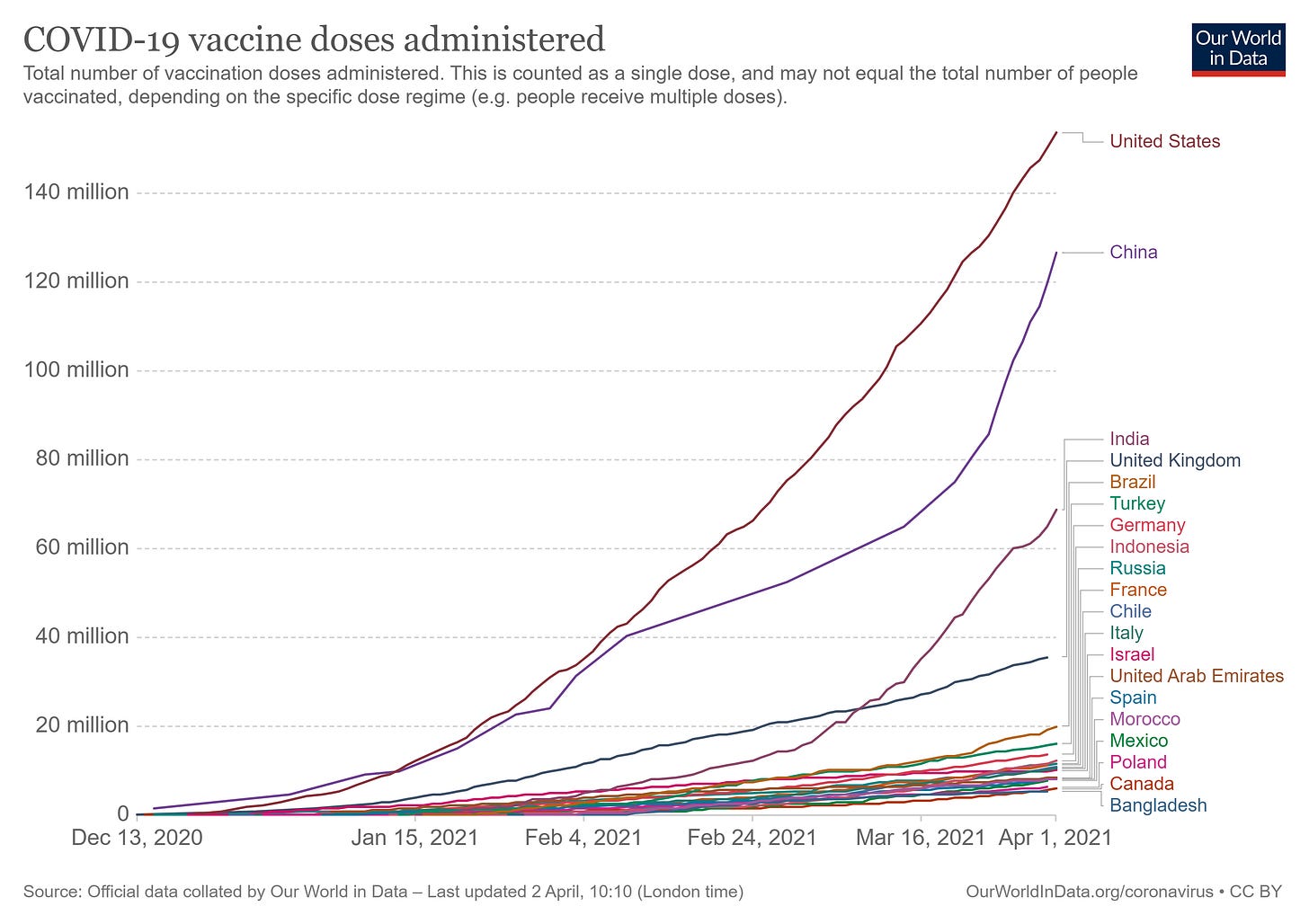

Also, China’s domestic vaccination campaign is clearly accelerating. As I noted in TCS March 19, I believe China’s domestic production and distribution capacity is a potential restraint to Beijing’s ability to fulfil vaccine commitments abroad. The accelerating campaign in China suggests that either Beijing is prioritising domestic inoculations over their foreign diplomatic efforts, or that their productive capacity has increased to fulfil both domestic and foreign commitments. With Beijing’s approval of another local vaccine “ZF2001” in mid-March, we could be looking at the latter scenario.

Note that the graph below shows doses administered. The new ZF2001 vaccine requires three doses over two months. So, we should expect to see China’s figures to accelerate as the first wave of second and third doses are administered, against the vaccines that most other countries are using, which require one or two doses.

Paraguay 🇵🇾

Taiwan Donates Helicopters, Covid-19 Drugs to Paraguay - Bloomberg - March 25, 2021

Taiwan donated three military helicopters Thursday, and on Wednesday said it would provide surgical gowns and 190,000 doses of Covid-19 drugs Atracurio and Midazolam [note - these are drugs for treatment, these are not vaccines], which are in short supply in Paraguay.

On March 29, Paraguay received 100,000 doses of India’s domestically developed and produced covid vaccine “Covaxin”. The dosage regime is two doses, 28 days apart.

Paraguay is scouring the globe for vaccines after obtaining just 63,000 shots for its 7 million people since mid-February.