The China Signal - April 23

Mexico nationalises its lithium industry; operations suspended in Las Bambas copper mine; China's "Canton Fair"

G’day, and welcome to The China Signal. This week, Mexico’s move to nationalise its lithium industry targets Ganfeng Lithium via its Bacanora Lithium operations in Sonora; operations again suspended in Las Bambas copper mine in Peru; China’s “Canton Fair” with Argentina and Colombia, plus more. Read on.

Critical Minerals ⚙️📱

Mexico 🇲🇽 + Latin America + China 🇨🇳

Following the defeat of Mexican President Andrés Manuel López Obrador’s (“AMLO”) controversial efforts to nationalise the country’s energy network in Mexico’s lower house, Mexico’s congress approved an amendment to nationalise lithium resources and prohibit private participation in lithium extraction.

As a result, the Mexican government will review all existing contracts and concessions. Of particular note are Bacanora Lithium’s operations in Sonora. Bacanora Lithium was recently acquired by Chinese lithium giant Ganfeng Lithium (see TCS August 26). The project, which is expected to begin operations in 2023 and to produce 35,000 tonnes annually, was highlighted by AMLO as one of the main projects to be reviewed, just as a new state-owned lithium mining company is formed in the coming weeks.

Ganfeng Lithium is the world’s largest lithium extractor. In 2020, Ganfeng extracted 24% of the world’s lithium hydroxide, and it has recently acquired sizable new projects throughout the region, from Mexico to Argentina.

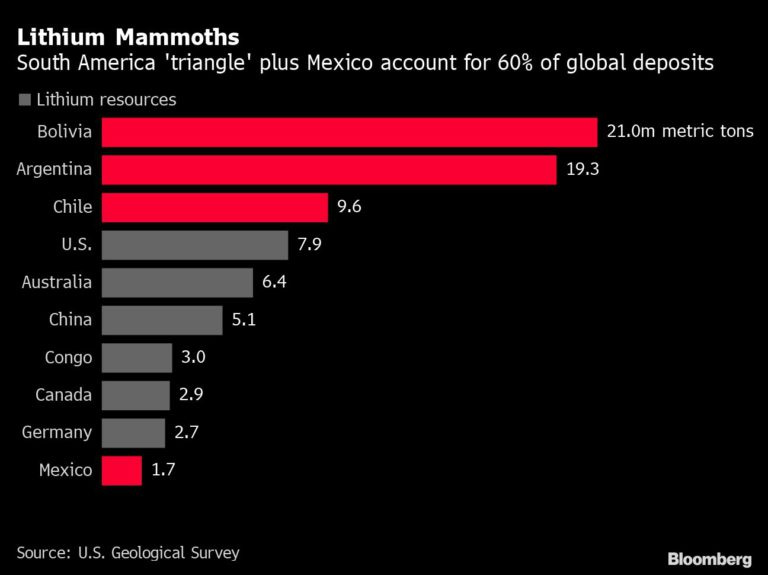

Mexico is not yet a significant lithium producer, but favourable market forces have drawn the attention of Chinese companies who already have interest in the Lithium Triangle (Argentina, Bolivia, and Chile). Mexico’s reform will undoubtedly cool this enthusiasm, although Ganfeng assures it complies with Mexican regulations and that it will continue to work with the government.

To the consternation of private lithium developers, Mexico’s actions align with a growing trend across other lithium-rich countries in the region. Bolivia nationalised its lithium resources in 2008, while in Argentina, noteworthy members of the Fernandez administration’s coalition are calling for lithium nationalisation. Chile’s constitutional convention has also been a stage for pushing the government to nationalise the country’s lithium. (IA)

ESG 🌎 🌳 + Natural Resources 🪨

Peru 🇵🇪

MMG's Las Bambas copper mine in Peru to suspend operations after protest | Reuters | April 19, 2022

On Wednesday April 20, Mineral and Metal Group Ltd. (MMG)’s Las Bambas copper mine (Apurímac region) suspended operations after 130 residents of the neighboring community Fuerabamba trespassed the firm’s property, according to Raúl Jacob, head of the local Sociedad Nacional de Minería, Petróleo y Energía (National Society of Mining, Oil and Energy, SNMPE) chamber.

As mentioned in TCS April 4, Las Bambas complex is not new to protests and blockades. It has suspended operations several times since operations began in 2016. The project is 62.5% owned by MMG, who in turn is majority owned by China Minmetals Corporation (CMC) via a subsidiary China Minmetals Non-ferrous Metals Co. Ltd (CMN).

~Above for the full Spanish article~

This new protest is due to frustrated talks between locals and the Ministry of Energy and Mines (Ministerio de Energía y Minas, MINEM). Locals also cite unmet social commitments by the government, including a claim that authorities have not provided land to allow for a community relocation as promised.

In parallel, Southern Copper Corporation’s Cuajone copper mine (Moquegua region) has suspended operations since February 28, when residents had the company’s water supply cut off. SNMPE estimates these two shutdowns affect over 10,000 workers. The Las Bambas and Cuajone mines produced 20% of Peru’s copper in 2021. Peru is the world’s second largest copper producer. (RP)

Bolivia 🇧🇴

~Above for the full Spanish article~

The journalistic alliance ManchadosXelPetróleo has found that hydrocarbon blocks currently overlap 21 of the 53 national and subnational Bolivian protected areas located in the heart of the Amazon.

The country’s protected areas were first opened to hydrocarbon activity in 2013, under former President Evo Morales’s government. As a result, oil companies were authorized to explore and exploit within these key Bolivian ecosystems. Two Supreme Decrees followed in 2015 and earlier this year.

According to the report (paraphrased translation):

Fundación Amigos de la Naturaleza (FAN), a Bolivian organization that works in the implementation of actions for the conservation and maintenance of natural heritage, assures that the oil situation in protected areas changed with [these two] new regulations. This was confirmed in a geospatial analysis carried out in the Bolivian Amazon, together with experts from the Amazonian Network of Georeferenced Socio-environmental Information (RAISG), which revealed how the Bolivian Amazon area went from having 73 215 square kilometers of oil areas in 2012 to 156 583 square kilometers distributed in 76 lots in 2020, meaning it doubled its extension in the past decade. According to FAN, 27% of Bolivia's protected areas are now at risk from oil activity.

Of the overlapping protected areas, the state-owned Yacimientos Petrolíferos Fiscales Bolivianos (YPDB) company operates in all 21; in 8 cases being supported by private companies. Overall, 75% of Bolivia's natural parks and integrated management areas overlap with concessions of the Spanish Repsol, the Brazilian state-owned Petrobras and the Bolivian-Venezuelan PetroAndina, being Amboró, Tipnis, Madidi and Pilón Lajas the most affected areas in the Amazon, Centro de Documentación e Información Bolivia (CEDIB) informs. In 2015, YPFB also signed contracts with the companies Sinopec International Petroleum Service Ecuador S.A. (“Sinopec Ecuador”)* and BGP Inc.* for US$100 million for oil exploration in the Amazon (* see backgrounders below).

Background: Sinopec International Petroleum Service Corporation + Sinopec Group (“China Petrochemical Corporation”) 🔍

Established in October 2002, Sinopec Ecuador is a branch of contractor Sinopec International Petroleum Service Corporation, which in turn is a fully-owned subsidiary of state-owned oil giant Sinopec Group (also known as “China Petrochemical Corporation”).

China Petrochemical Corporation is the largest oil and petrochemical products supplier and the second largest oil and gas producer in China. It is also the largest refining company and the second largest chemical company in the world. In 2021, it ranked 5th on Fortune’s Global 500 List with revenue over US$407 billion. It is headquartered in Beijing.

Background: BGP Inc. + China Petroleum National Corporation 🔍

BGP Inc. is a subsidiary of state-owned China Petroleum National Corporation (“CNPC”). It was formally established in 2002 following its merger with six other geophysical divisions of CNPC operating within different parts of China.

CNPC is China's largest oil and gas producer and supplier. It is one of the world's major oilfield service providers. In 2021, it ranked 4th on Fortune’s Global 500 List with revenue over US$379 billion. It is headquartered in Beijing. (RP)

Pandemic Diplomacy 🏥

Colombia 🇨🇴

~Above for the full Spanish article~

In response to a request made by the Oficina de Relaciones y Cooperación (Office of Relations and Cooperation), the Chinese Embassy made a donation of biosecurity supplies to support the work of the Secretaría de Salud Pública Distrital (District Public Health Secretariat) in Cali, Colombia’s third largest city. The press release mentions that:

The donation delivered by the Chinese embassy includes 13,000 pairs of NBR gloves, 140,000 disposable surgical masks and 1,000 protective suits to overcome events that put local health at risk.

In mid-March 2022, the Mayor's Office of Cali and Tianjin, China, had signed a virtual Letter of Intent (LoI) for the establishment of cooperation and friendship relations. (RP)

Trade 🤝

Argentina 🇦🇷 + Colombia 🇨🇴

Canton Fair: Trade Bridge Connecting China and Latin America | Yahoo Finance | April 19, 2022

*Note: This article was sponsored by China Import and Export Fair (“Canton Fair”). Canton Fair is co-hosted by the Ministry of Commerce and the Guangdong Province local government.

Two events of the 131st Canton Fair Virtual Promotion, with one between China and Argentina and the other between China and Colombia, were recently held to promote trade in electronics and household appliances.

…Yu Yi, Deputy Director General of the Foreign Affairs Office of the Canton Fair, attended and addressed the meeting. Around 300 Argentine and Colombian representatives of industry and commerce associations, buyers and suppliers took part in the online events.

The Chinese companies and their Latin American counterparts discussed a variety of topics, including product functionalities and import and export regulations. (RP)

Colombia 🇨🇴

~Paraphrased translation from Spanish~

…Colombia's imports from China during February 2022 reached US$5,8 billion, an increase of 49.2% compared to the same period of 2021.

The most imported products were machinery and transportation equipment, chemical and related products, and petroleum (products and related products). Colombia's share of imports from China was 27.7% of total foreign purchases.

The Year-on-Year increase was driven by growth in mobile phones (66% increase), and laptop computers (85%). (RP)