The China Signal - February 26

Chinese loan and economic activity in 2020, 5G in Brazil, a hospital to Bolivia, and vaccine diplomacy for the long term

G’day, and welcome to The China Signal! This week we’ve got a pair of terrific reports on China’s financial and broader economic engagement with the region in 2020; 5G auction spectrum rules are approved in Brazil - without any conditions on Huawei; a mobile hospital donation to Bolivia’s army; an overview of China’s vaccine diplomacy - there for the long term; and investigative articles adding colour on the China-Venezuela relationship.

Welcome to my new readers, and it was great speaking with some of you this week.

Deals and Investments

Broader Latin America and the Caribbean 🏔🏝

The Inter-American Dialogue and Boston University’s Global Development Policy Center released their annual update to their China-Latin America Finance Database this week, accompanied by two reports, below, and a webinar.

Shifting Gears: Chinese Finance in LAC, 2020 - The Dialogue - February 22, 2021

This report and its associated Finance Database track “official lending” from China’s policy banks - the China Development Bank, and the China Export-Import Bank from 2005 to 2020.

Main Findings

CDB and Eximbank issued no new loans to LAC governments and state-owned enterprises in 2020. Though a first in recent China-LAC relations, the absence of financing this year is also reflective of a broader, downward trend in Chinese finance to the region, evident since 2015. See the Dialogue-GDP China-Latin America Finance Database for details.

There are multiple reasons for the recent downturn in Chinese finance. For instance, in 2020, CDB and Eximbank largely focused on addressing the challenges associated with pandemic-era project management, including by issuing low-cost finance and working capital loans to Chinese companies operating overseas.

China’s record of sovereign lending to the region no longer surpasses that of other major development banks. China has issued over $136 billion in credit to the region since 2005, according to Global Development Policy Center and Inter-American Dialogue estimates. But as of 2019, sovereign lending to LAC from the World Bank and the Inter-American Development Bank (IDB) exceeded China’s record over the same period.

Despite the continued drop in Chinese state-to-state finance in the region, it is possible that LAC nations will see some loans from China’s policy banks in 2021. Talks began in 2020 for a possible $2.4 billion loan to Ecuador, but the deal had yet to conclude by year-end. Also, in a statement to his Latin American and Caribbean counterparts in July 2020, Chinese Foreign Minister Wang Yi announced that China would offer $1 billion in loans to LAC governments to assist with the purchase of China’s Covid-19 vaccines.

The combined effect of Chinese policy bank activity, co-financing initiatives, commercial bank finance, and other forms of lending will ensure a sizable Chinese financial presence in the region for years to come, potentially in a wider variety of projects. China’s three regional funds—the China-LAC Industrial Cooperation Investment Fund (CLAI Fund), China-LAC Cooperation Fund (CLAC Fund), and Special Loan Program for China-Latin America Infrastructure—have backed a growing number of LAC projects in recent years, including amid the pandemic.

China-Latin America Economic Bulletin, 2021 | Global Development Policy Center

For the first time in 15 years, China’s two policy banks, China Development Bank (CDB) and the Export-Import Bank of China (ExImBank) signed no new financing commitments with LAC governments. Instead, renegotiations of existing debts began, culminating in the suspension of $891 million in payments by Ecuador.

China donated $215 million in medical aid to LAC countries. Nearly half of this amount— over $100 million—went to Venezuela.

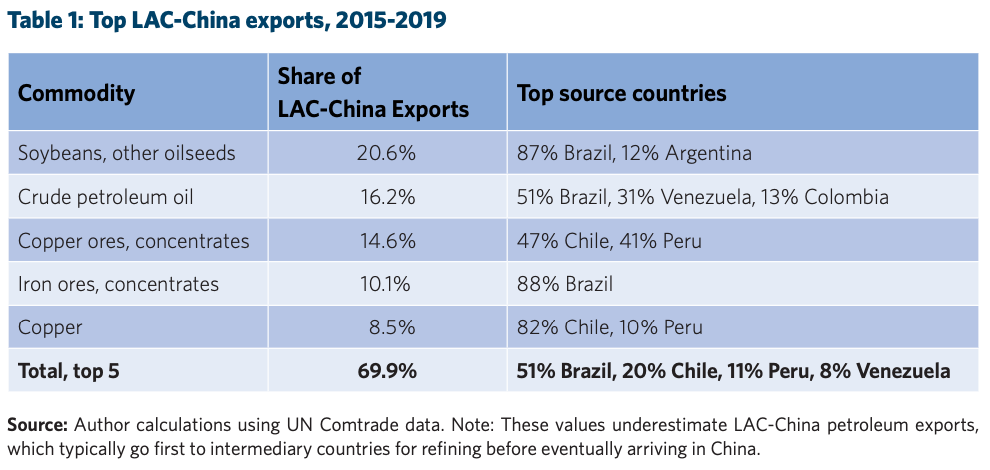

LAC-China trade held steady despite the regional downturn, at an estimated $136 billion in LAC-China exports and $160 billion in Chinese exports to LAC. Given the sharp economic slowdown, LAC’s trade with China rose to record levels as a share of regional GDP, at an estimated 3.8 percent of GDP in imports and 3.2 percent of GDP in exports.

Behind these trade results were rising iron prices, as China’s economic stimulus drove demand for construction materials. Also driving trade was China’s continued demand for Latin American soybeans, despite its commitments to return to buying from US suppliers under the China-US “Phase One” trade deal.

New (“greenfield”) Chinese investments in LAC sagged, and included just a few major announcements, all of which are still pending: three Chinese automobile manufacturers announced the intention to invest in Mexico and a local subsidiary of China General Nuclear Power Corporation announced its intention to build 800MW in new solar energy generation facilities in Brazil.

Nonetheless, Chinese mergers and acquisitions in LAC grew to $7 billion as Chinese energy companies took advantage of Sempra Energy’s sale of its interests in the Chilean and Peruvian electricity sector. Together, China Three Gorges and State Grid Corporation bought over $6.5 billion of these assets.

2021 may see a rebound in investment and finance, as China has offered $1 billion in loans for vaccine purchases and has begun negotiations with Ecuador for a new loan for oil. Argentina has begun negotiating an ambitious investment package worth $30 billion, particularly in transportation and agricultural projects.

Stepping back from these reports, it’s a useful reminder that China’s relationship with the region, and elsewhere, is dictated by their own core interests, which rest on the bedrock of the Chinese Communist Party maintaining political power and control of their society. This hinges on a variety of factors, led by:

Sustaining economic growth

Fostering a strong sense of national identity

Providing a relatively comfortable and environmentally healthy way of life to its citizens.

This has shown in the data presented in both of these reports:

Regional exports to China increased relative to other export destinations, driven by Beijing’s efforts to stimulate its own economic recovery.

Yet for the same reason, coupled with local economic conditions and supply chain disruptions in Latin America, China’s official lending to the region was non-existent in 2020.

Medical donations and vaccine arrangements to the region were strategic, and aimed at softening perceptions of China, and normalising their presence beyond pure trade and investment.

China’s broader strategy hasn’t changed, but its tactics have evolved to current macroeconomic conditions in China and Latin America, to China’s maturing economic footprint in the region, and to a more complex geopolitical operating environment.

Venezuela 🇻🇪

Last week I shared the first two investigative articles in an ongoing series on the China-Venezuela relationship, courtesy of a partnership between Dialogo Chino, Armando.info, and the Latin American Centre for Investigative Journalism (CLIP). The articles are a little bit speculative, but I think their value is in the context and colour that they add to our understanding of the China-Venezuela relationship.

The third article in the series traces the unfulfilled promise of a white goods factory backed by Chinese loans:

Haier in Venezuela: White goods factory draws blanks - Dialogo Chino - February 21, 2021

In the short to medium term, the project promised technological independence so that Venezuela could manufacture its own ‘white goods’ - domestic appliances that include washing machines, cookers, refrigerators, and air conditioners - all at low cost for poor Venezuelan households. No one would ever have to wash by hand again. Nor would they ever be too hot. Much less would food be lost due to lack of refrigeration. So went Chávez’s orders.

A decade later, Yare was left with a blank promise rather than white goods.

As it turned out, China paid in and got its change. The loans from Beijing to finance the construction of the factory were used to buy precisely the same finished products that it was supposed to manufacture. And from China too.

The fourth investigates $164 million in funds earmarked to refurbish an office space for a “Joint China Venezuela Office” for Beijing officials in Caracas to monitor its extensive loan portfolio in the country:

The world's most expensive public office is a mess - Dialogo Chino - February 24, 2021

The $164 million refurbishment was paid for through an 'operating expenses' sub-account of the loan scheme. But despite its astronomical costs, today the mystifyingly expensive office lies in disrepair.

The office refurbishment was so disproportionately expensive that it even cost more than some of the most important works from the China agreements it was supposed to oversee.

Trade

Brazil 🇧🇷

Brazilian agribusiness booms despite international tensions - Dialogo Chino - February 23, 2021

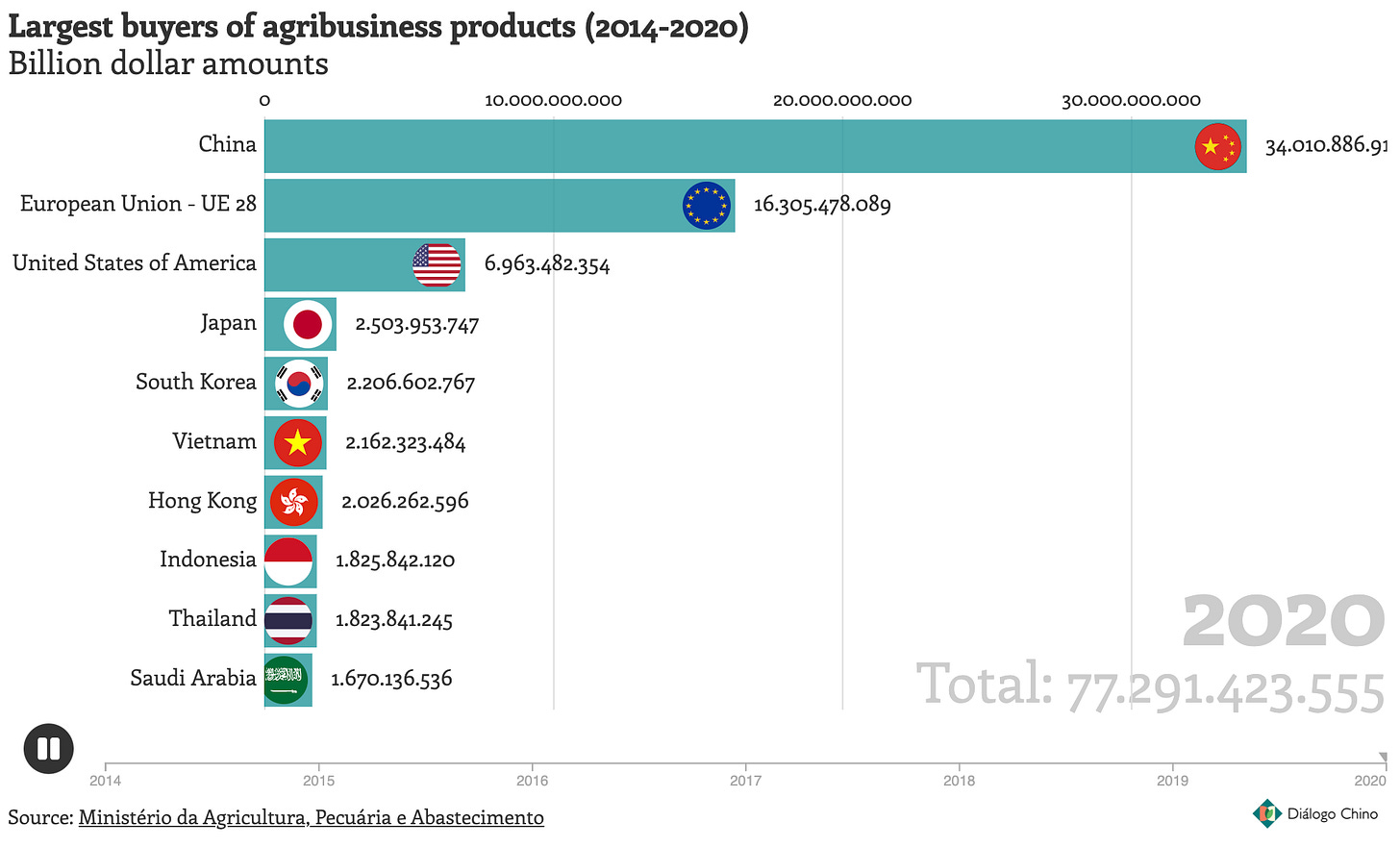

China is the top buyer of Brazil’s agricultural products. The country buys more than half of the meat and soybeans that Brazil sells abroad, even with the bad weather the Bolsonaro clan and its inner circle has generated.

5G

Brazil 🇧🇷

Brazil regulator approves 5G spectrum auction rules, no Huawei ban | Reuters - February 25, 2021

Brazil’s telecoms regulator Anatel approved rules on Thursday for a spectrum auction for 5G networks this year without any curbs on China’s Huawei Technologies Co as an equipment supplier.

Brazil’s telecom companies insisted on a free market, complaining that excluding Huawei would cost billions of dollars to replace the equipment of the Chinese company that supplies 50% of the current 3G and 4G networks.

Rules for the auction expected in June, however, have costly conditions such as requiring telecom companies to migrate by next year to more advanced technology with stand-alone networks not based on their current technology.

They will also have to cover the vast northern Amazon region with broadband connectivity, largely using optic fiber cables laid in rivers, and build a separate secure network for the federal government.

Two of Brazil’s main telecom companies, Telefonica Brasil SA and Claro, owned by Mexico’s America Movil, are pressing for a 5-year transition to the more advanced stand-alone networks.

The rules must be approved by Brazil’s Federal Audit Court, the TCU, where the telecoms hope the government’s onerous conditions can be changed, Suruagy said.

Diplomacy

Bolivia 🇧🇴

“China donates to Bolivia a mobile military hospital against covid-19”

China dona a Bolivia un hospital militar móvil contra el covid-19 - Infobae - February 18, 2021

~Paraphrased Translation~

The donation, given to the military, consists of nine vehicles equipped with medical operation, first aid, X-Ray imaging, oxygen, laboratory and sterilisation facilities.

This sounds similar to the donation to Argentina’s military, described last week’s TCS.

La donación, entregada a los militares, consiste en nueve vehículos acondicionados para realizar operaciones médicas, primeros auxilios, diagnóstico por rayos X, utilizar un generador de oxígeno, realizar análisis de laboratorios bioquímicos y esterilización.

Broader Latin America and the Caribbean 🏔🏝

For Covid-19 Vaccines, Latin America Turns to China and Russia - WSJ - February 24, 2021

The rollout in Latin America, home to 650 million people, will give China and Russia an early foothold in a multibillion-dollar vaccine market. As health experts now warn of a drawn-out pandemic, updated vaccines will be needed to combat new variants of the coronavirus.

It is also a geopolitical advantage for China and Russia. The vaccines could boost their standing in a region where Beijing wants access to oil, copper and soybeans and Moscow has been building stronger diplomatic and economic ties. For the foreseeable future, the region is dependent on Chinese and Russian vaccines.

“It places them in a position to go head-to-head and challenge the dominance of Europe and the U.S. in many of those countries because vaccines are it,” said Monica de Bolle, a Brazilian who is a senior fellow at Peterson Institute for International Economics. “You can’t have functioning economies without vaccines.”

Latin America’s early reliance on Chinese and Russian vaccines emerged out of necessity as the U.S. and other developed nations bought up nearly all the Western-made shots, from companies such as Pfizer Inc. and Moderna Inc.

Our World In Data has been collecting vaccine administration by manufacturer. In Latin America, data is only available for Chile, so far. Chile has received praise for the efficiency of its vaccine rollout, and as you can see below, this is driven by the availability of China’s Sinovac.