The China Signal - January 8

Chinese regional M&A activity, a contract dispute in Ecuador, and illegal fishing

G’day, welcome to The China Signal, and happy new year! In this edition - China’s M&A activity in a pandemic year with rising international political tensions; Brazil lapses on BRICS development bank payment; a major contractual dispute in Ecuador; and China’s ongoing illegal fishing. Plus more.

Thanks to those new readers who signed up over the Christmas period. Please share this newsletter with those who would find it useful!

Investments and Deals

Broader Latin America

Latin America Emerges as China’s Favorite Hunting Ground for M&A - Bloomberg - December 27, 2020

Leer en español aqui.

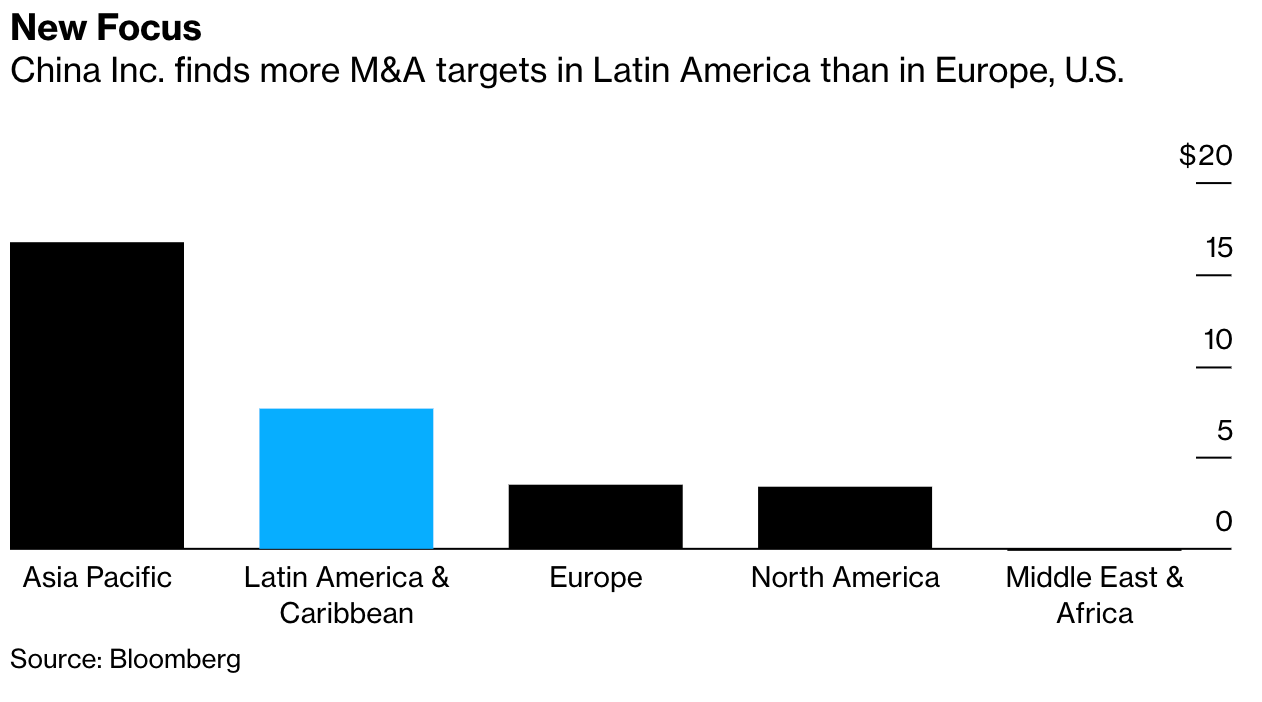

Overseas acquisitions by Chinese firms are heading for their fourth consecutive yearly decline, with a $31.1 billion tally that’s the lowest since 2007, according to data compiled by Bloomberg. Transactions targeting Latin America totaled $7.7 billion, more than Europe and North America combined.

China’s largest foreign acquisition for 2020 was State Grid Corp.’s purchase of a controlling stake of Chilean electricity utility CGE, valued at USD 5.2bn (including debt). This was covered in TCS December 4. Other major deals highlighted were:

…State Grid also completed its purchase of Sempra Energy’s assets in Chile earlier this year.

In Mexico, China’s State Power Investment Corp. bought the nation’s largest independent renewable energy company, Zuma Energia. Another government-owned energy giant, China Three Gorges Corp., previously acquired Sempra’s businesses in Peru for almost $3.6 billion.

Brazil

Brazil defaults on BRICS bank agreement after Congress blocks payment - The Hindu - January 6, 2021

Brazil's Economy Ministry onTuesday said it had defaulted on its penultimate capital instalment to the New Development Bank (NDB) because the payment had not been authorised by Congress.

The NDB was established by Brazil, Russia, India, China and South Africa, a group of emerging economies known as the BRICS. Brazil in 2015 agreed to pay its contribution to capitalize the bank in seven installments.

Brazil's two outstanding instalments total $350 million, the Ministry said.

As per the founding agreement (specifically Article 9 & Attachment 2), all five founding members are required to capitalise the bank across seven instalments, the last two of these being USD 350 million each.

Ecuador

China y Ecuador entran en otra pugna contractual - Expreso - January 6, 2021

“China and Ecuador enter into another contractual dispute”

[Paraphrased translation]

An agreement between the Electric Corporation of Ecuador (Celec) and Chinese state owned entity Harbin Electric International (HEI) resulted in irregularities and fines exceeding USD 20 million, according to Ecuador’s Office of the Comptroller General of the State. The fines are owed to the state, and remain outstanding.

The contract was signed in 2013 to distribute energy from Ecuador’s hydroelectric plants into the country’s electricity grid.

The Office of the Comptroller General of the State accused HEI of failing to hire and train the minimum required number of Ecuadorian personnel, and failing to deliver the contractually stipulated amount of telecommunications spare parts.

The Comptroller also accused Celec of failing to monitor HEI’s compliance with environmental regulations.

China’s commercial office plans to appeal the decision and pursue legal action.

Argentina

In TCS December 18, I noted that the Argentinian government had signed four agreements worth USD 4.7 billion with a group of Chinese SOEs to upgrade rail freight lines and rolling stock. However more recent reports listed approximately USD 1.2bn of this as MOUs, not legally-binding contracts. Further details below.

San Martin

…CRCC [China Railway Construction Corporation] will invest $US 2.6bn to renovate the 1813km San Martin freight line, and will restart services on the line following the completion of work. The upgraded line, which connects the provinces of Buenos Aires, Santa Fe, San Luis, Cordoba, and Mendoza, will offer improved freight links between Argentina’s western agricultural provinces, and the eastern ports of Rosario and Buenos Aires.

Belgrano

A contract signed with CMEC [China Machinery Engineering Corporation] will cover the restoration of the 911km Belgrano Cargas line, which runs through the regions of Jujuy, Salta, Tucuman, Cordoba, San Luis, Santa Fe, Buenos Aires, and Catamarca.

Under the contract, CMEC will provide $US 816m of funding for the project, of which 65% of funding will be allocated to cover construction costs, and 35% for rolling stock and other equipment. The upgrades are expected to generate 6202 jobs.

Norpatagonico

An Memorandum of Understanding (MoU) signed with CMEC will cover the $US 784m refurbishment of the 660km southern Norpatagonico line, including the construction of 80km of new line to Añelo and the replacement of signs and turnouts, and the renovation of depots.

The project also includes plans to renew existing track between Bahía Blanca to Contraalmirante Cordero. Tren Norpatagonico renovation is intended to enable the development of the Vaca Muerta shale gas fields…

Rolling Stock

A $US 490m MoU with CRRC International will cover the provision of 211 electric rail vehicles to replace existing diesel fleets on lines in Buenos Aires and 13 other Argentinean provinces.

Diplomacy

Argentina

Argentina’s President Alberto Fernandez and China’s Xi Jinping continued to exchange “letters” as part of a push from Argentina to secure Chinese covid-19 vaccines. What’s most interesting to me however, is media outlet Mercopress’ coverage of this and other LatAm China news, which is often a direct yet unattributed regurgitation of Chinese state media propaganda. The read out from this presidential exchange is only the latest example:

Xi calls for closer partnership with Argentina - China.org.cn - January 5, 2021

Mercopress calls itself an “independent news agency” based in Montevideo, Uruguay.

Side note: Argentina’s ambassador to China, Luis María Kreckler, has recently been removed by President Fernandez, following negative press of his lavish lifestyle, his embassy’s slow progress in negotiating a vaccine agreement with China, and domestic political rivalries.

Broader Latin America

On 4 November, in a landmark example of increasing joint efforts in the region to combat potential illegal, unreported, and unregulated (IUU) fishing by the Chinese fleet, the governments of Chile, Ecuador, Peru, and Colombia issued a joint statement condemning IUU fishing and specifically calling out the “large fleet of foreign-flagged vessels.” The statement committed the group to greater information-sharing efforts and to take joint action to condemn acts of IUU fishing that occur in their EEZs through the Permanent Commission to the South Pacific (CPPS), a maritime regulatory body in which the four countries hold equal membership.

In December 18’s China Signal (“TCS”), Chinese vessels were reportedly off the coast of Chile. The latest information has them off the coast of Argentina. Further information on the region’s efforts to confront Chinese IUU fishing can be found in TCS November 6.

The countries are also expected to highlight the issue at the next meeting of the South Pacific Regional Fisheries Management Organization, COMM9, taking place between 21 January and 1 February, 2021.

Regional pressure on Chinese IUU fishing has also been complemented by U.S. diplomatic pressure:

…executives from Fuzhou, Fujian Province, China-based distant-water fishing firm Pingtan Marine Enterprise Ltd., listed publicly on the NASDAQ Stock Exchange, had their travel visas revoked [on December 7, 2020] as part of an escalation in U.S. sanctions against China over alleged involvement in IUU fishing.