The China Signal - March 19

Cofco's merger and IPO plans, Brazilian beef, Colombian Garments, Chinese tourism, vaccine diplomacy

G’day, and welcome to The China Signal! This week: Cofco, China’s largest food corporation announces merger and IPO plans - with ramifications for its extensive LatAm operations; new figures show Brazil’s dominance in beef exports to China in 2020, Colombian garment manufacturers push for greater trade protection against Chinese and other Asian garment importers; Trip.com signs a 5 year MOU with Argentina to promote Chinese tourism to Argentina; vaccine productive capacity vs. diplomacy, plus more. Read on.

Also, on April 8, I will be sharing my analysis on the complex Australia-China relationship, and opportunities it can bring for Mexican companies in a webinar with the Australia, New Zealand and Mexico Business Council. If you’re interested, you can sign up here.

Deals and Financings

China 🇨🇳 - Broader Latin America 🏔🏝

China Plans New Food-Trading Giant With Cofco Merger and IPO - Bloomberg - March 15, 2021

China’s largest food company plans to merge its international trading division with several domestic businesses to create a new agricultural commodity behemoth before embarking on an initial public offering.

Cofco Corp. has hired bankers to advise on a plan to combine Cofco International Ltd. with some of its domestic trading and processing assets, according to people familiar with the talks. After the merger, Cofco plans to sell shares in the new company, most likely in Shanghai, the people said, asking not to be identified as the matter is private. The IPO could value the new company at more than $5 billion, the people said.

The combination will create a new agricultural trading giant, putting Cofco’s international trading unit and some of its domestic businesses under one umbrella, with assets spanning from Brazil to China, the people said. The new company will compete with the so-called ABCDs, a quartet of global traders which have dominated the industry for decades: Archer-Daniels-Midland Co., Bunge Ltd., Cargill Inc. and Louis Dreyfus Co.

The merger is expected to raise more funds which will help drive growth of the company’s domestic and overseas business, said Ma Wenfeng, an analyst at Beijing Orient Agribusiness Consultant Co. “It needs money to expand overseas resources because part of the role of a state-owned company is to ensure the country’s food security,” Ma said.

…Outside investors currently own about 49% of CIL, with Cofco controlling the rest.

The merger is expected to be completed this year with the potential IPO possibly planned for the end of 2021 or early 2022, the people said.

With the merger, Cofco will combine the market savvy of its international trading venture, which is one of the largest soybean exporters from South America, with its domestic assets that trade and process agricultural commodities in China.

Cofco International has a Latin American presence in Argentina, Brazil, Colombia, Mexico, and Uruguay.

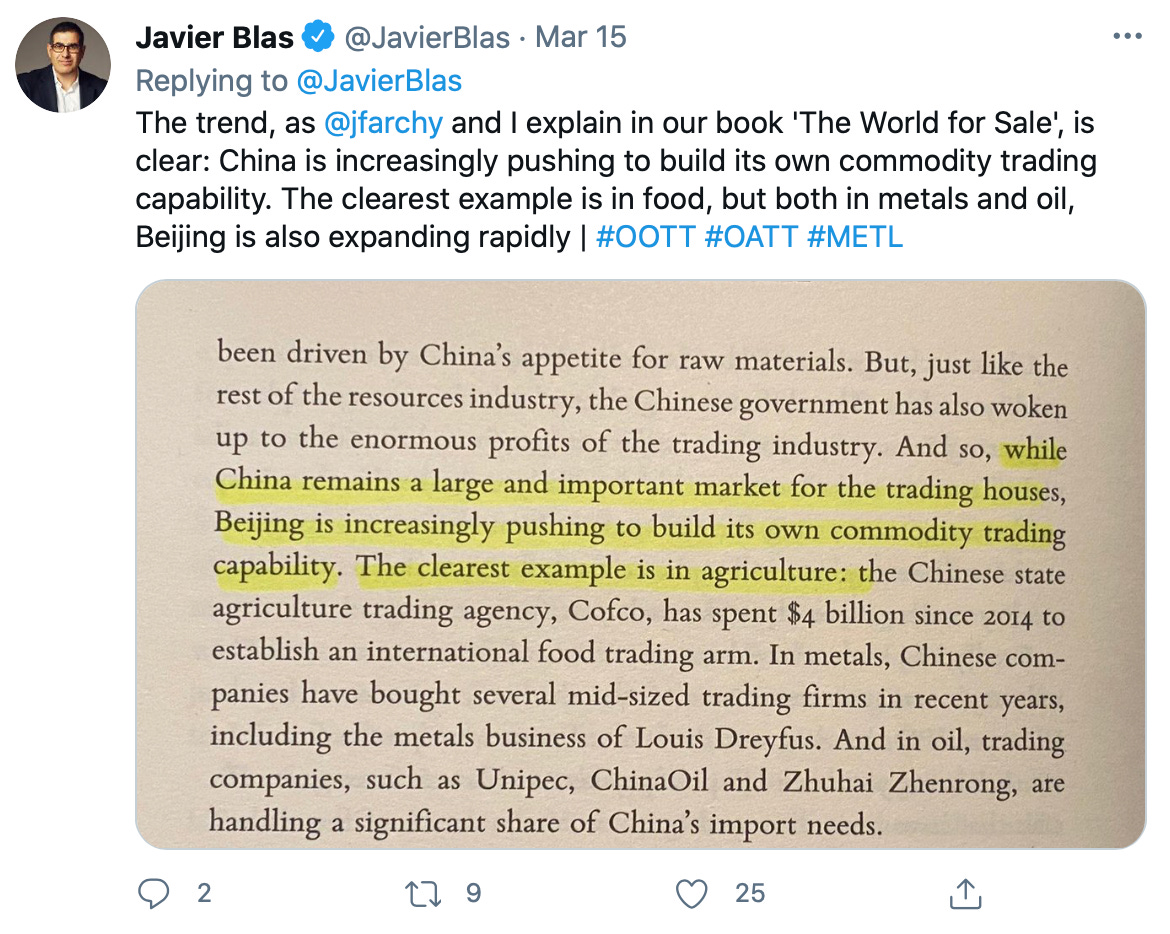

Javier Blas, one of the article’s authors shared his personal views on Twitter:

Trade

Brazil 🇧🇷

Brazil supplied 43% of China’s meat imports in 2020, the consultancy Safras & Mercado calculated using government data, with beef exports to the country up a staggering 76% last year compared with 2019.

“There has been this boom,” says Thiago de Carvalho, a professor of agribusiness at the University of São Paulo, highlighting the quality of Brazilian beef and its low price after the Brazilian currency, the real, tumbled last year. “Brazilian meat is [among] the cheapest in the world.”

Sales are predicted to climb even higher this year, as China’s pork industry struggles to recover from the deadly pig disease African swine fever.

Almost 70% of China’s Brazilian meat imports came from the Cerrado, the vast tropical savanna region, and the Amazon in 2017, according to Trase (Transparency for Sustainable Economies), a European network that monitors supply chains. About half of the Cerrado and about 20% of the Brazilian Amazon have been cleared – with a devastating impact on global heating as both are important carbon sinks.

Colombia 🇨🇴

This article is a nice reminder to map the full political-economic dynamic of China’s relationship with Latin American countries. Trade is dominated by Latin American exports to China, but when understanding the political impacts, we can’t ignore who loses from the deepening economic relationship. This is “Political Economy of Trade 101”, where domestic import competitors chafe at competition from foreign trade. In this case, Colombia’s garment industry is pushing for tariffs to be placed on low-cost garment imports from Asia, including China.

Colombia’s apparel industry is demanding the government increase duties against a flood of sub-valued Asian imports that threaten additional job losses following the 120,000 operators let go in 2020.

“The government needs to decide if it wants to protect employment here or hand it to Asian countries,” Camilo Rodriguez, president of Colombia’s Apparel And Related Products Chamber (CCCyA), told Sourcing Journal.

Bowing to industry pressure, Bogota unveiled an industry-splitting decree a fortnight ago, hoping to stem Asian imports from denting local sales amid heavy losses brought on by the pandemic. Retail sales, for instance, plunged 22 percent last year.

Argentina 🇦🇷

Trip.com is a Chinese multinational online travel company, headquartered in Singapore.

On 9th March 2021, Trip.com Group signed a five-year strategic Memorandum of Understanding (MOU) with the Argentina Ministry of Tourism and Sports to further enhance business, cultural and social exchange between China, Argentina and across Trip.com Group's vast networks of users and partners.

…It is understood that over the next five years, the two parties will collaborate on travel marketing initiatives, products and data, and fully optimise the travel experience for tourists in Argentina.

*Xinhua is a state-sponsored news agency.

Leer la entravista en español.

Argentina is eagerly awaiting the arrival of Chinese travelers to boost tourism in the wake of the COVID-19 pandemic, Argentina's Minister of Tourism and Sports Matias Lammens told Xinhua recently.

Calling China "the world's leading source of tourists," Lammens said he had recently signed a memorandum of understanding with the Chinese travel agency Trip.com Group to strengthen tourism between the two countries in the post-pandemic era.

However, in order to draw more Chinese travelers, Argentina will need to meet the challenge of improving connectivity, since currently most Chinese visitors come via the United States, noted the minister.

"We are working on a flight that can come directly through Asia," said Lammens.

A China Daily article quotes the number of Chinese visitors to Argentina growing to approximately 60,000 visits in 2017. Roughly speaking, this equates to less than 1% of 6.7 million tourist visits to Argentina in 2017, according to World Bank statistics. Lots of room to grow.

Vaccine Diplomacy

China 🇨🇳

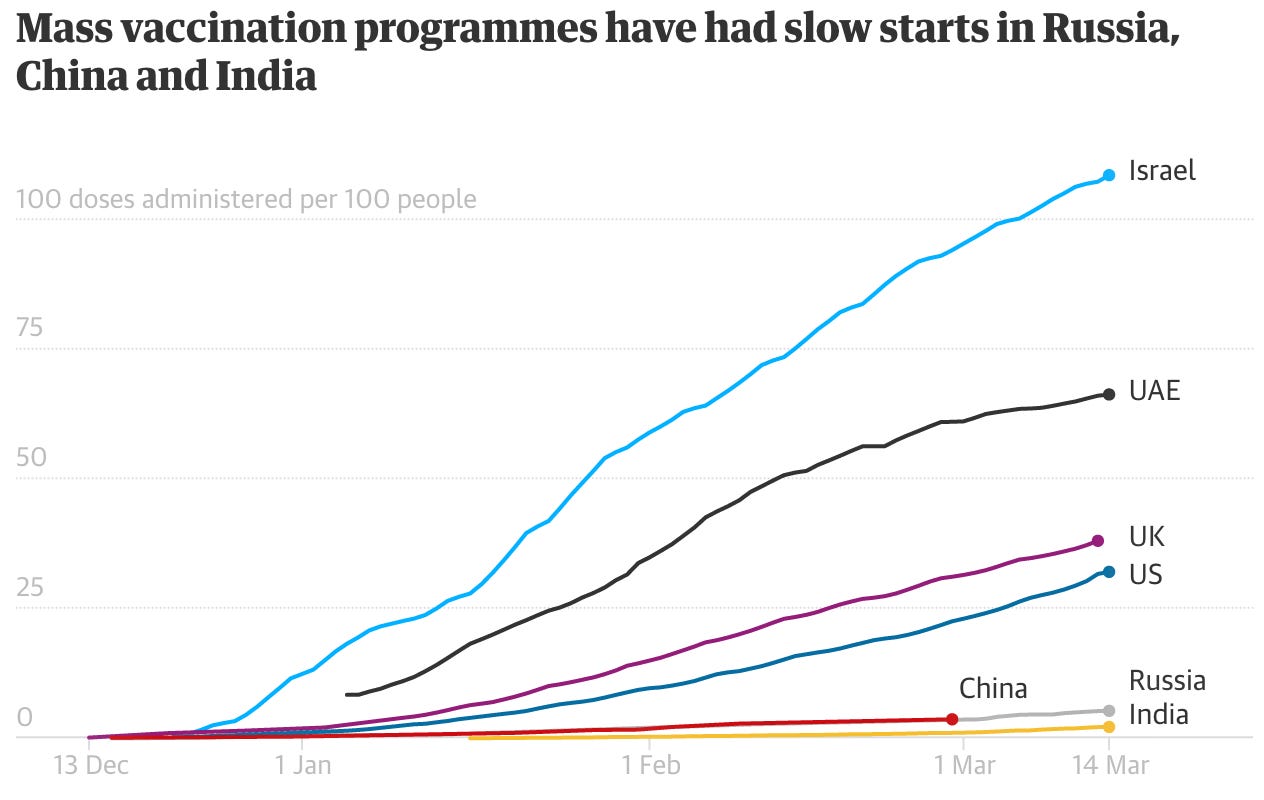

China’s domestic vaccine rollout has been very slow, given that they were the epicentre of the outbreak, and have had a vaccine available since July 2020. Beijing’s goal is to vaccinate 40% of their population by July, with only 4% of the population currently inoculated. While the virus is generally under control within China for now, new outbreaks could put pressure on their vaccine diplomacy abroad, should they choose to prioritise domestic vaccinations with greater urgency. Approval of a third vaccine “ZF2001”, detailed below, could further relieve supply pressures. China and the West’s vaccine production and distribution capacity is a key factor to watch in this space, to ascertain whether China’s foreign vaccine commitments can be fulfilled.

The same is true for the average resident of Beijing, though not for demographic reasons. China has employed blunt but effective quarantine measures to contain Sars-CoV-2 successfully, and life in the country has largely returned to normal. Though it authorised its first vaccines for emergency use in July, just 4% of the country has been vaccinated so far.

“One of the most important contributors is this perception that China has a low risk of infection,” said Yanzhong Huang, director of the Center for Global Health Studies at Seton Hall University in New Jersey. “So people think, why bother to get vaccinated? We’re already safe.”

The country aims to inoculate 40% of its population by July, a target that will require administering about 4m shots a day, up from about 640,000 a day on the latest public figures.

But Beijing must also balance commitments to supply at least 463m doses to countries overseas, many of them donations to strategic partners. So far, it is under little pressure to hoard those vaccines for use at home. “People view this as an example of China being a global leader, something that showcases China being a responsible and reliable great power,” Huang says.

With 65 million doses administered as of Sunday, China needs to average around 4 million shots a day to meet that target.

Vaccine developers’ statements suggest manufacturers could reach an annual capacity of 3.6 billion doses by the end of the year, according to Reuters calculations: 3.1 billion doses of the three approved vaccines that require double injections and 500 million single-dose shots.

That would be enough to vaccinate China’s entire population eventually and honour its commitment to supply at least 463 million doses overseas through donations and exports.

But none of the makers of the approved vaccines - China National Pharmaceutical Group (Sinopharm), CanSino Biologics Inc (CanSinoBIO) or Sinovac Biotech Ltd - has detailed how many doses they are producing after their latest scale-up.

Sinovac said in early February that its capacity to make finished products lagged behind its bulk production capacity, but overseas partners could help fill bulk vaccine into vials and syringes.

China’s latest Covid-19 vaccine to win emergency approval is expected to be cheaper and easier to produce on a large scale, without the need for specialised storage facilities. But it will need to be given in three doses over two months for best protection.

The vaccine, known as ZF2001, was granted approval last week for emergency use in China, where hopes of inoculating up to 80 per cent of the population to achieve herd immunity have been constrained by a production bottleneck. It was approved for use in Uzbekistan last month and is in phase 3 trials there as well as Indonesia, Pakistan and Ecuador.

According to industry experts, production for this kind of vaccine is stable and reliable, and easier to achieve large-scale industrial production at home and overseas. It can also be stored and transported at 2-8 degrees Celsius, making it potentially more suitable in countries where specialised storage and distribution facilities may be limited.

Brazil 🇧🇷

Brazil Needs Coronavirus Vaccines. China Is Benefiting. - The New York Times - March 15, 2021

It was nice to connect this week with Ernesto Londoño, one of the article’s authors and NYT Brazil bureau chief. Welcome to The China Signal community.

With Covid-19 deaths rising to their highest levels yet, and a dangerous new virus variant stalking Brazil, the nation’s communications minister went to Beijing in February, met with Huawei executives at their headquarters and made a very unusual request of a telecommunication company.

“I took advantage of the trip to ask for vaccines, which is what everyone is clamoring for,” said the minister, Fábio Faria, recounting his meeting with Huawei.

Two weeks later, the Brazilian government announced the rules for its 5G auction, one of the biggest in the world. Huawei, which the government appeared to have barred just months before, will be allowed to participate.

The precise connection between the vaccine request and Huawei’s inclusion in the 5G auction is unclear, but the timing is striking, and it is part of a stark change in Brazil’s stance toward China. The president, his son and the foreign minister abruptly stopped criticizing China, while cabinet officials with inroads to the Chinese, like Mr. Faria, worked furiously to get new vaccine shipments approved. Millions of doses have arrived in recent weeks.

The request for vaccines by the Brazilian communications minister, Mr. Faria, occurred as it became clear Beijing held the keys to accelerate or throttle the vaccination campaign in Brazil, where more than 270,000 people have died of Covid-19.

In an interview, Mr. Faria said there was no quid pro quo suggested in his request to Huawei for help with vaccines. In fact, he said, he also asked executives at competing telecommunications companies in Europe if they could help Brazil obtain shots.

Paraguay 🇵🇾

(Continuing from the NYT article above).

In a sign of China’s growing leverage, Paraguay, where Covid-19 cases are surging, has struggled to gain access to Chinese vaccines because it is among the few countries in the world that have diplomatic relations with Taiwan, which China considers part of its territory.

In an interview, Paraguay’s foreign minister, Euclides Acevedo, said his country is seeking to negotiate access to CoronaVac through intermediary countries. Then he made an extraordinary overture to China, which has spent years trying to get the last few countries that recognize Taiwan to switch their alliances.

“We would hope the relationship does not end at vaccines, but takes on another dimension in the economic and cultural spheres,” he said. “We must be open to every nation as we seek cooperation and to do so we must have a pragmatic vision.”

With protests breaking out in the capital Asunción in recent days, Paraguayans are unhappy at how far their country lags the rest of the continent in vaccine inoculations. Taiwan is aware that the value of their diplomatic relationship with Paraguay is at stake. Beyond words of support, below, there are no details on the the ability of Taiwan to boost vaccine supply to Paraguay. Taiwan itself hasn’t yet begun administering vaccines in their own country.

Taiwan says helping ally Paraguay to buy COVID-19 vaccines | Reuters - March 16, 2021

In a statement late on Tuesday, Foreign Ministry spokeswoman Joanne Ou said Taiwan was extending a helping hand to Paraguay at a time when it was facing a public health crisis and unable to obtain enough vaccines.

“Based on the friendship between Taiwan and Paraguay, under the existing bilateral cooperation framework, we are assisting Paraguay to negotiate and obtain vaccines through different channels,” she said.