The China Signal - March 5

China's copper demand boosts Codelco, DiDi to Ecuador, Sinopharm embroiled in Peru's "vacunagate", illicit animal trade

G’day and welcome to The China Signal! This week, Bumper profits from Chile’s Codelco highlight the political and economic importance of their China relationship as an economic driver; DiDi prepares to launch in Ecuador; Sinopharm revealed as a key player in Peru’s “vacunagate” scandal; illicit animal trade networks between the region and China exposed; plus more. Read on.

Did I miss anything? Have something you’d like to share or discuss? Reach out at any time.

Trade

Chile 🇨🇱

Chile’s Codelco, the world’s top copper producer, reported pre-tax profits of $2.078 bln in 2020 and said it had upped output from its own mines by 2% to 1.618 mln tonnes, despite being forced to rely on skeleton crews for almost half the year amid strict measures aimed at curbing the coronavirus outbreak.

The 55% increase in profits came amid a surge in global metal prices and higher sales as global markets including Chile’s main buyer China begin to rally from the pandemic.

The company, which turns over all its profits to the Chilean state…

Approximately 50% of Chile’s copper exports are sent to China. I’m no commodities analyst, but as a political-economic analyst, its market forces like these that create economic winners and losers, and shape the contours of political relationships at a state and business level.

China's appetite for copper provides Chile with opportunity - AFP - February 24, 2021

Copper rose to $4.21 a pound on the London Metal Exchange on Wednesday, meaning it has doubled its price since March 2020.

A reminder:

Chile produces close to a third of the world's copper and copper represents 10-15 percent of national GDP.

However, supply is increasing, which should see copper prices begin to stabilise.

Copper Crunch Set to Ease With More Supply Heading to China - Bloomberg - February 26, 2021

Chinese copper smelters grappling with a shortage of semi-processed material are set to see an influx of supply from South America, a sign that the tightness helping supercharge the metal’s rally may be easing.

Starting next month, there’ll be a large number of ships arriving at Chinese ports from Chile and Peru, the nation’s main suppliers, as bottlenecks ease, according to IHS Markit lead shipping analyst Daejin Lee. The amount of concentrate expected to reach the Asian nation may climb almost 60% from February’s volume, he estimated.

Tech, 5G

Ecuador 🇪🇨

Nice PR from DiDi’s local team here, too. This is essentially a press release, which also appears in “expreso” almost verbatim.

~Paraphrased translation~

DiDi is now accepting registrations for drivers Quito, Ecuador. DiDi is highlighting its service rate of 15%, one of the lowest in the country, in a bid to compete with Uber and Cabify.

DiDi is available in Mexico, Chile, Costa Rica, Panama, the Dominican Republic, Colombia, Peru, Brazil, Argentina and now Ecuador, starting in Quito. The company has around 550 million registered users around the world.

DiDi, una nueva aplicación de movilidad, confirmó que, a partir de esta semana, inicia registros para socios conductores en la ciudad de Quito, con una tasa de servicio del 15%, una de las más bajas del país según sus representantes.

Desde hace unos años la plataforma de tecnología ha centrado su foco en Latinoamérica. Está disponible en México, Chile, Costa Rica, Panamá, República Dominicana, Colombia, Perú, Brasil, Argentina y ahora Ecuador, comenzando por la ciudad de Quito. La compañía cuenta con alrededor de 550 millones de usuarios registrados alrededor del mundo.

Broader Latin America and the Caribbean 🏔🏝

In 2021, however, that strategic neutrality faces an unprecedented challenge. After being subject to diplomatic pressure from both the United States and China over the past few years, numerous Latin American governments will have to finally decide whether to allow Huawei to provide equipment for the construction of their 5G cellular networks. This pits the Chinese firm, which has a long-standing presence in Latin America’s main markets, directly against U.S.-backed competitors—and there will be no pleasing both sides.

After Chile began its 5G auction in 2020 without banning Huawei from supplying components, most Latin American countries are now in the process of defining the rules of their own bidding processes. Aware of the potential backlash their decisions may have on ties to either Beijing or Washington, governments will likely either attempt to include caveats—for example, not banning Chinese suppliers but establishing monitoring mechanisms in an attempt to appease Washington—or attempt to negotiate generous financial support from Washington in exchange for limiting or banning Huawei outright. Whatever they decide, it is bound to have far-reaching consequences not only for individual nations but for Latin America as a whole.

Vaccine Diplomacy

Peru 🇵🇪

“Sinopharm sent Peru ‘VIP’ vaccines and gifts for the Ministry of Health”

China’s Sinopharm is now caught up in Peru’s “Vacunagate” scandal.

~Paraphrased translation~

As the Peruvian government negotiated vaccines purchases with Sinopharm and and other pharmaceutical companies last year, Sinopharm sent the Peruvian government a separate batch of vaccines outside of those sent for experimental phase III trials. These additional vaccines were subsequently administered late last year to then President Martín Vizcarra, his wife, and other political elites - including some of the government’s vaccine negotiators at the Foreign Ministry and Ministry of Health. The scandal broke in mid-February.

According to the newspaper La Republica, the additional vaccines weren’t ordered by the Peruvian research team in charge of the vaccine’s clinical trial as originally claimed, but were accepted following a direct offer from Sinopharm. Additionally, two media sources report that the Chinese company gifted $860,000 in medical supplies to the Ministry of Health, while negotiations were still underway.

In the first week of December, then Minister of Health Pilar Mazzetti, announced that they had reached an agreement in the negotiations with Pfizer, which fell apart days later.

On January 7, President Francisco Sagasti announced the signing with Sinopharm of the purchase agreement for 38 million doses, and the commitment to ship the first million vaccines. That shipment arrived in February and has been administered to health care workers.

La farmacéutica Sinopharm ofreció en agosto enviarle al Gobierno peruano un lote aparte de vacunas en fase experimental III y no se trató de un pedido del equipo peruano a cargo del ensayo clínico del producto, según reveló el diario La República. Además, dos medios reportaron que la empresa china envió insumos médicos de regalo al Ministerio de Salud por valor de 860.000 dólares. Todo ello mientras el país sudamericano negociaba con ésta y otras farmacéuticas la compra de vacunas para la población.

La publicación especializada Salud con Lupa informó que las donaciones de la compañía estatal china -ventiladores mecánicos, dispositivos de oxígeno, termómetros infrarrojos y miles de equipos de protección personal, entre otros- llegaron en tres embarques en septiembre, noviembre y el 15 de enero. La primera semana de diciembre, la entonces ministra de Salud, Pilar Mazzetti, anunció que habían llegado a un acuerdo en las negociaciones con Pfizer, pero días después se cayó. Entre los primeros funcionarios que se vacunaron irregularmente con las dosis que la empresa china envió por fuera de las destinadas al ensayo clínico estaban los negociadores de la Cancillería y el Ministerio de Salud para la adquisición de vacunas.

El 7 de enero, el presidente Francisco Sagasti anunció la firma con Sinopharm del acuerdo de compra de 38 millones de dosis y el compromiso para enviar el primer millón de vacunas. Ese embarque llegó en febrero y ha servido para inmunizar al personal de salud.

Broader Latin America and the Caribbean 🏔🏝

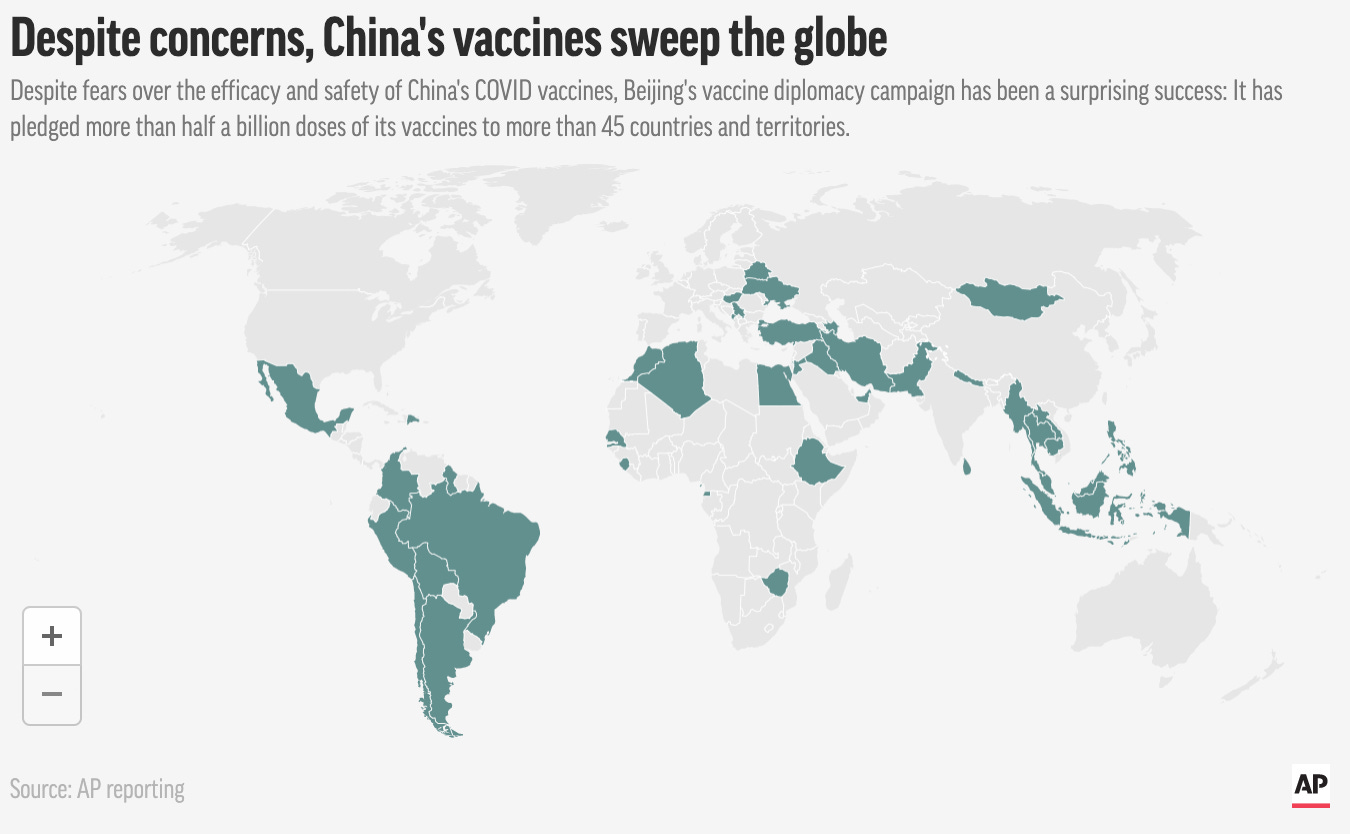

Chinese vaccines sweep much of the world, despite concerns - Associated Press - March 2, 2021

Note this graphic shoes vaccine pledges across the world. Also, Venezuela should be coloured green in the graphic. Venezuelan state media reported the arrival of 500,000 doses of Sinopharm’s vaccine on March 1.

The Wilson Center also maintains an interactive map of covid-related aid from China and the United States received in Latin America. Note footnote three on the graphic’s webpage - these are official government donations only. On China’s side per the footnote, donations have also been made from Huawei, BGI, China Three Gorges Corporation, NBFE, CHCEC, Alifante, Tencent, CNPC, GAC Group, DiDi, ZTE, CATIC, Alibaba, COSCO, CCCC Dredging Group, Dahua Technology, Microport, Fosun, COFCO International, Trip.com Group, WanHuida, Nu Group, Yutong, Tencent, China Communications Construction, ICBC, Bank of China, TikTok, and Envision Energy.

The Wilson Center recently published reports on the United States’ and China’s aid to Latin America:

Latin America and China in Times of COVID-19 | Wilson Center - October 2020

Diplomacy

Colombia 🇨🇴

Xi Jinping stressed that as China actively fosters a new development paradigm, it will provide new cooperation opportunities for Colombia. China is willing to work with the Colombian side to push for greater development of bilateral ties. The two sides should continue to support each other, and better synergize the Belt and Road Initiative and the Colombia-China Initiative. While deepening traditional cooperation in energy, infrastructure, telecommunications and other areas, the two sides should also actively expand cooperation in such new fields as agriculture, husbandry, new energy, digital economy and creative industries, and deepen exchanges and cooperation in culture, education and sports as well as at local levels. China will continue to encourage Chinese enterprises to invest and do business in Colombia, and stands ready to strengthen cooperation with Colombia within multilateral frameworks such as the United Nations.

Does anyone know what exactly the “Colombia-China Initiative” is? I’ve seen the phrase mentioned since Duque’s 2019 state visit to China, but never clearly defined. There seems to be some “constructive ambiguity” being exploited here to give both governments some room. Colombia has resisted signing on to the BRI, so referring to the bi-lateral economic relationship as the “Colombia-China Initiative” provides some nice optics, and allows each government to interpret its vagaries to their own political benefit.

Chile 🇨🇱

TCS reader Evan Ellis published an overview of the Chile-China relationship this week. As always it is incredibly thorough, and well worth reading in its entirety. In his own words via email, Ellis argues in his article that:

…Chile’s relatively strong governance structures and commitment to transparency,

institutional procedures and a level playing field have helped the country

benefit from its engagement with the PRC relative to the less transparent,

more idiosyncratic nature of the embrace by leftist populist governments in

the region. Chile's approach has also caused important setbacks for some

Chinese companies, yet has not refrained China's advance, nor has it

completely insulated the country from some of the more predatory elements of

government-supported PRC business practices.

Chinese advances in Chile - Global Americans - March 2, 2021

In a testament to Chilean aversion to being manipulated and bullied, China’s aggressive “wolf warrior” ambassador in Chile, Xu Bu, was discretely forced to give up his posting early and return to the PRC because he was seen as too aggressive for Chile, which takes pride in its strong institutions and autonomy.

Unfortunately, Chile’s institutional strengths have not completely inoculated it against the risks of engaging with the PRC. The COVID-19 pandemic has deepened Chile’s vulnerability to Chinese influence; with relatively few firms looking to make new investments in the South American country in the near future, and numerous Europe-based companies looking to sell off assets, there are few alternatives beyond Chinese investors.

Illicit Trade

Broader Latin America and the Caribbean 🏔🏝

Latin America's Bustling Trade in Seahorses to China - InSight Crime - February 27, 2021

An investigation has identified Mexico as a major contributor to a global seahorse trafficking network centered around China but this trade is also affecting other Latin American nations.

The report, published in February by Mongabay and Diálogo Chino, documented that close to 100,000 seahorses were trafficked illegally between Mexico and China, most often bound for Beijing, Hong Kong and Shanghai.

While it is technically possible to legally export seahorses from Mexico with the right environmental permits, the country has frozen the granting of such permits for the time being.

In China, seahorses are in demand for use in traditional Chinese medicine

According to the article, a kilogram of seahorse fetches over USD $1,000 in Chinese markets.

InSight Crime found cases of thousands of seahorses being trafficked from Brazil, Panama, Peru and Ecuador, among other countries.

Some seizures even suggest that Latin America is starting to play the role of an intermediary transit point with a much more complex trafficking system than first thought. In 2017, for example, a shipment of West African seahorse species confiscated in Vietnam was found to have first passed through Peru.

Dialogo Chino also recently covered illegal seahorse trade from Mexico to China.

Bolivia 🇧🇴

This investigation identifies at least three such criminal groups operating in Bolivia and composed almost entirely of resident Chinese nationals. The groups are concentrated in the departments of Santa Cruz and Beni, specifically in the municipalities of San Borja, Rurrenabaque and Riberalta. The preferred means of transport is by plane, either on commercial flights or cargo shipment. The method depends on the quantity being transported and, in many cases, involves a bribe to a local authority.

One of these gangs, known as Putian, is thought to have a direct relationship with the Fujian criminal group in Hong Kong. The Fujian syndicate is one of the most powerful of Hong Kong’s notorious triad groups. “What we want to highlight is that this business is not in the hands of three or four people, but of an organization,” says ELI’s Crosta.

“The Chinese mafia has hidden casinos, runs money laundering activities and controls the cocaine business in Bolivia,” one of the traffickers told a Chinese undercover ELI agent. The investigation shows these syndicates also have legitimate businesses, including restaurants and shops, which often function as a front for trafficking jaguar parts and other contraband, from wildlife to drugs.

Their activity, according to sources, is concentrated in the departments of Santa Cruz and Beni, run by Chinese citizens living in remote regions, following a pattern seen across the rest of Latin America.

According to ELI, the “need for tiger parts,” combined with the possibility of replacing them with jaguar parts — in a country with a large number of jaguars — and the arrival of Chinese investments in Bolivia, have come together to create a “perfect storm.” Thaís Morcatty, a Brazilian researcher at Oxford Brookes University, published a study last year on the relationship between Chinese investment in infrastructure projects and jaguar trafficking.

Deals and Investments

No major announcements this week.

Ecuador 🇪🇨

Ecuador’s exporters caught between US and China after debt deal - Financial Times - March 2, 2021

Some colour on the political-economy of the China-Ecuador relationship. Who “wins”, who “loses”, and how this shapes the relationship.

One of the smallest countries in South America, Ecuador has traditionally exported primarily to the US and Europe, but China is fast catching up. Its share of Ecuador’s exports jumped from 3.9 per cent in 2015 to 15.8 per cent. In the same period, the US’s share fell from 39.4 per cent to 23.7 per cent.

The Chinese buy oil, shrimp, bananas, cut flowers, cacao and timber from Ecuador. Last year, despite the coronavirus pandemic, Ecuador’s exports to China grew more than 10 per cent and, for the first time, the country boasted a trade surplus with Beijing.

This statement sums up the growing economic and political situation that many countries within and beyond Latin America are finding themselves in with China:

“China will remain our main market,” forecast José Antonio Camposano, president of Ecuador’s National Chamber of Aquaculture (CNA), which oversees the industry. “We need a smart approach to China. A market of 1.4bn people with the acquisitive power that the Chinese have? I’m a businessman, how can I say no to that?”

Venezuela 🇻🇪

Dialogo Chino have published the next article in their partnership with Armando.info, and the Latin American Centre for Investigative Journalism (CLIP), providing some colour on the rocky China-Venezuela relationship.

The Chinese train derailed on Venezuela’s plains - Dialogo Chino - March 3, 2021

But they are part of a 13,665-kilometre railway system on which trains should now be running, from one principal point of the country to another. At least that is what was foreseen in the 2006 National Socialist Plan for Railway Development, the realisation of which was partly guaranteed by the Venezuelan-Chinese Joint Fund (FCCV). The ambitious railway plan was initially designed by the Ministry of Infrastructure (Minfra), through the then State Railway Institute (IFE).

Fifteen years later, however, only 40 kilometres are in operation, barely 0.29% of the total planned.

Yet, promises never turned into reality as the company responsible for carrying out the work, the state-owned China Railway Engineering Corporation (CREC), got bogged down by disputes with Veneuelan labour, bureaucratic hurdles and language barriers. In the end, CREC withdrew from the works not only without completing them - it barely made 31% progress - but also without delivering the promised technology transfer.