The China Signal - October 28

Brazilian oil exports plunge, CPTPP, Brazil's 5G auction, Brazilian beef

G’day, and welcome back to The China Signal! Thanks for your patience and understanding as I navigate my new, wonderful life as a father. The twins are now six months old, and I’m settling into a routine where I can begin to work more consistently again.

Picking back up with developments this past week, this edition covers Brazil’s slumping crude oil exports to China, Taiwan’s lobbying of Chile over its CPTPP application, Brazil’s upcoming 5G auction on November 4, Beijing’s continuing ban on Brazilian beef, plus more. Read on.

Oil

Brazil 🇧🇷

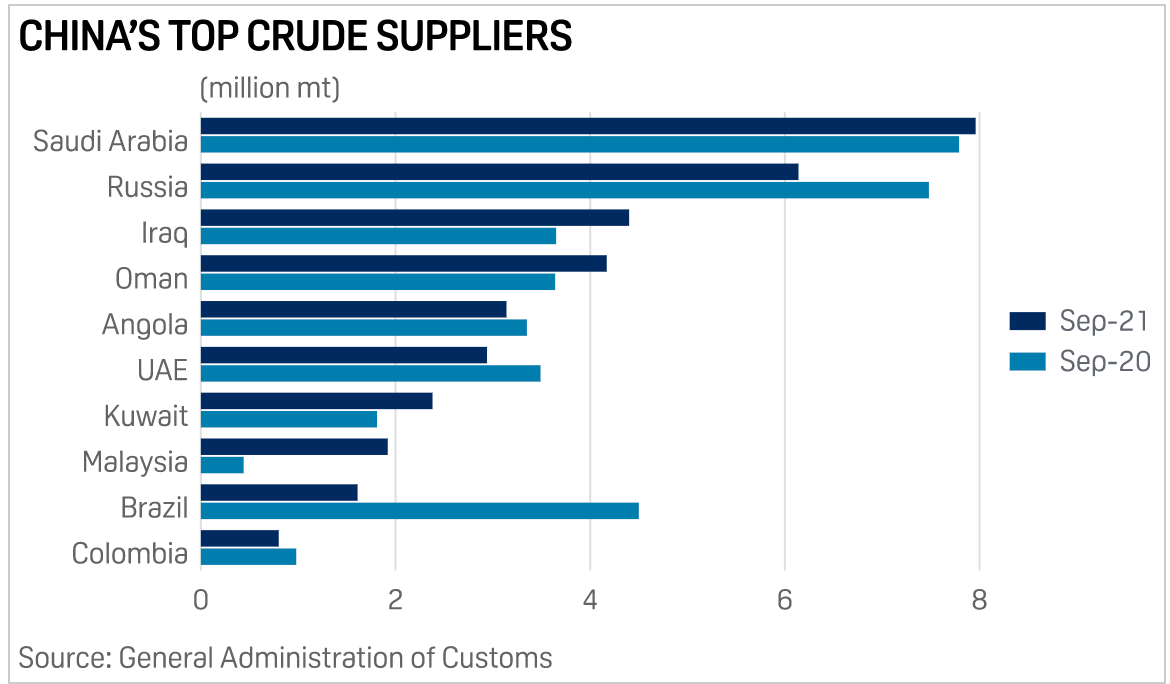

China’s crude imports from Brazil slumped 54.7% on the month to near four-year low of 380,000 b/d, or 1.61 million mt, in September, latest data released by the General Administration of Customs showed Oct. 20.

Weak buying from China’s independent refineries was the main reason for the decline in September, with the flow unlikely to stay low for the rest of the year, market sources said.

China’s crude imports from Brazil were last lower at 1.14 million mt in October 2017, according to the GAC data.S&P Global Platts’ data showed that China’s refineries only imported 172,000 mt of Brazilian crude in September, down sharply by 81.4% from August and 94.3% from a year earlier.

Brazil used to be a top crude supplier to the country’s independent refineries, following Russia and Saudi Arabia, but lower quality of imports has led domestic refineries in China to look for alternatives, according to market sources.

Trade

Chile 🇨🇱

Taiwan wants to discuss CPTPP application with Chile | Taiwan News | October 20, 2021

Chile will be one of the countries Taiwan will consult about its application to join the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) trade group after the Latin American nation indicated its support for China’s bid, Minister without Portfolio John Deng (鄧振中) said Wednesday (Oct. 20).

Taiwan filed its application on Sept. 22, but China did so on Sept. 16, causing fears that the communist country will try and block Taipei’s bid if it succeeds in joining first. While most countries gave a positive response to Taiwan’s decision, Chile reportedly was the first one of the CPTPP’s 11 members to give a more enthusiastic welcome to Beijing’s bid.

Deng, who serves as the government’s chief trade negotiator, said Wednesday that Taiwan would hold talks with Chile, Malaysia, and Brunei, even though those three countries did not hold decisive votes related to Taipei’s bid as they had not passed the necessary legislation, the Liberty Times reported.

5G

Brazil 🇧🇷

A reminder that Brazil’s long anticipated 5G auction is due to be held on November 4, where in a reversal by the Bolsonaro Administration, Huawei is being allowed to participate, despite misgivings from Biden Administration officials. Brazilian telco TIM is the latest firm to announce their plans to bid for 5G mobile spectrum.

Brazil’s 5G auction has been delayed multiple times. In TCS August 18 I noted how it was expected to to occur by October at the latest. I’ve previously discussed Brazil’s 5G dilemma with China in my USCC testimony (page 7.), TCS January 29, and January 22.

Dig deeper on the China-Brazil relationship with this Wilson Center podcast, featuring Claudia Trevisan, Executive Director of the Brazil-China Business Council. Trevisan authored an excellent report on the political economy China’s soft power in Latin America in January, which I featured in TCS January 22. I particularly recommend pages 1-7 of the report, which details a number of Brazil’s pro-China business sectors.

Agriculture

Brazil 🇧🇷

Shipments of Brazilian beef have been stopped from entering China due to an embargo in place since two cases of mad cow disease were reported in the South American nation in early September, frustrating exporters who had hoped shipments certified before the embargo would be free to pass.

The shipments are arriving at Chinese ports despite the embargo partly because exporters had expected it to only last about 15 days, the time a similar suspension lasted in 2019. But this embargo has lasted longer - now over 50 days.

The suspension mechanism is part of an animal health pact agreed between China and Brazil and is designed to allow Beijing time to take stock of the problem. It is up to China to decide when to begin importing again.

For Minerva Foods BEEF3.SA, South America's largest exporter of beef, the longer delay in lifting the suspensions goes beyond just the sanitary issues and is related to political tensions as well as higher meat stocks in China, CFO Edison Ticle said at an event on Wednesday.

According to comments provided to the Financial Times earlier this month, this Brazilian beef cannot be diverted to other markets, due to different certification and specification requirements, while the domestic Brazilian beef market is already saturated. According to these analysts, some of this beef will likely enter China though “grey channels” via third countries such as Vietnam and Hong Kong.

Latin America’s overall relationships with China

Latin America’s Evolving Relationships with China - Americas Quarterly - October 19, 2021

TCS reader Emilie Sweigart and Gabriel Cohen of Americas Quarterly have provided excellent, punchy summaries of China’s growing relations with Argentina, Brazil, Chile, Colombia, Mexico, Panama, Peru, and Venezuela through the pandemic.