The China Signal - September 28

Ecuador's debt deal, corruption scandals in Bolivia and Ecuador, disagreement over Argentina's nuclear power plant

G’day, and welcome to The China Signal. This week, Ecuador strikes a deal with China to restructure its debt; Bolivian authorities re-examine China Harbor Engineering Company contracts in an ongoing corruption scandal; Ecuadorian prosecutors raid Sinohydro’s offices; Argentine and Chinese officials quarry over details of nuclear power plant deal; two in-depth reviews of the China-Mexico relationship, plus more. Read on.

Finance

Ecuador 🇪🇨

Ecuador reaches deal with China to restructure debt | Reuters | September 20, 2022

Ecuador has reached an agreement to restructure $4.4 billion worth of its debt to China, the government said in a statement on Monday 19 September, providing debt relief worth some $1.4 billion until 2025. Specifically: (RP)

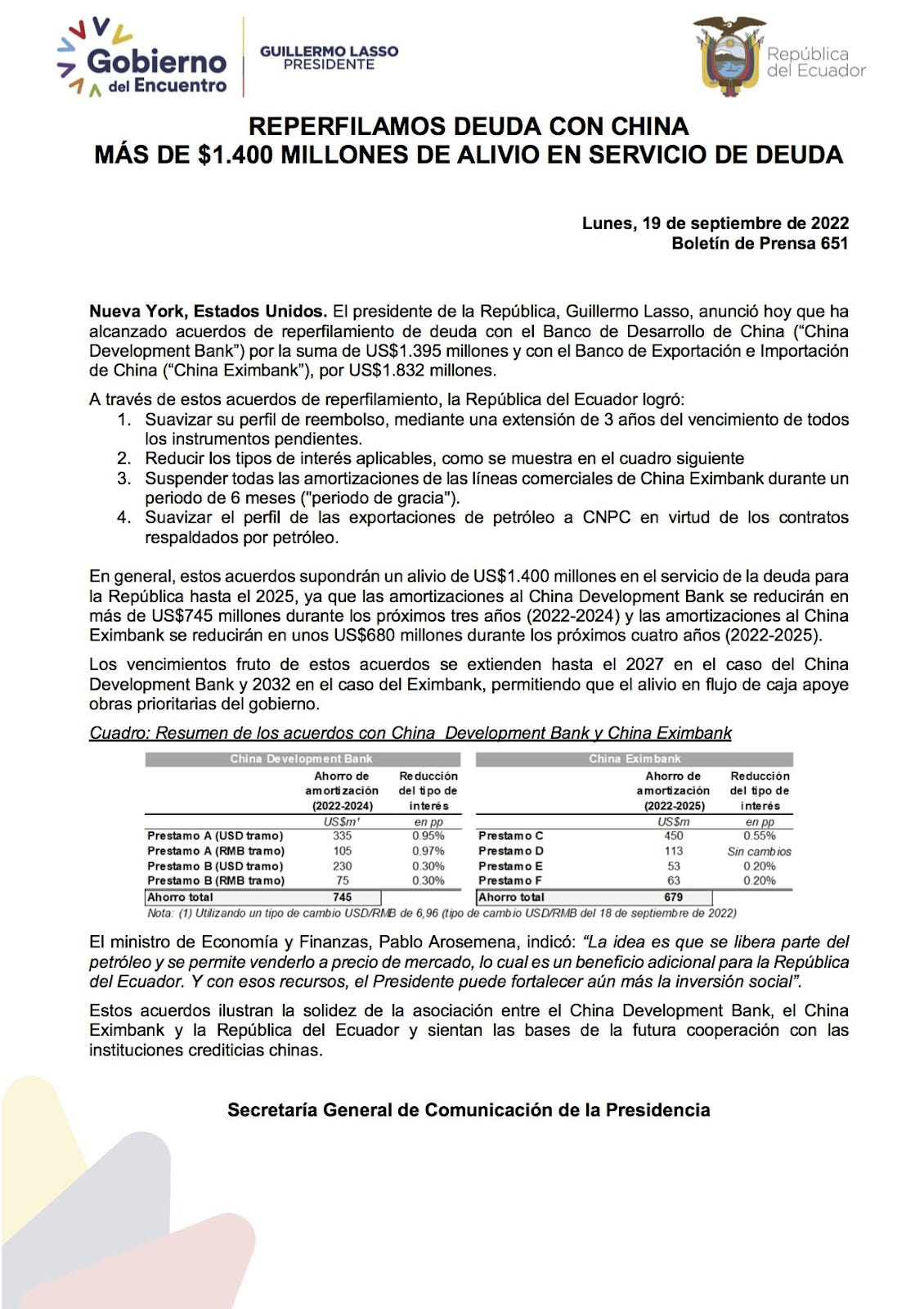

Agreements were reached with both the China Development Bank and the Export-Import Bank of China (Eximbank) for loans worth $1.4 billion and $1.8 billion respectively, extending the loans' maturity and reducing amortization.

"As a result of these agreements, the maturities are extended to 2027 for China Development Bank and 2032 for Eximbank, allowing the cash-flow relief to support government priorities," the president's press team said in the statement. Ecuador also managed to reduce certain applicable interest rates and suspend all amortizations with China Eximbank for a six-month grace period, the government said .

…The agreements also involve freeing up certain amounts of exports to Chinese oil company CNPC under oil-backed contracts, allowing Ecuador to sell an unspecified quantity of oil at market prices, the statement said.

See TCS February 10, TCS April 4, and TCS July 4 for further background.

Earlier on Wednesday 14 September, Ecuador's state oil company Petroecuador had said to have reached an agreement with Chinese oil company Petrochina (a subsidiary of the China National Petroleum Corporation - CNPC) on some deliveries of crude oil, part of a renegotiation of long-term contracts between the two companies.

With the agreement, 27 shipments of Ecuadorian crude for 2022 and 2023 will be released for sale, while Petroecuador will deliver another 80 at the spot market price to the Chinese firm. [Petroecuador did not specify the equivalent of the shipments in barrels of oil].

Petroecuador began negotiations with the Chinese oil firm last April in order to improve the price formula for Ecuadorian crude and the extension of the delivery schedule for shipments, which was set to expire in 2024.

Corruption 💼🤝

Bolivia 🇧🇴

Gobierno indagará contratos de la empresa CHEC en Bolivia | Los Tiempos | September 19, 2022

~ Article above is in Spanish ~

Following the recent Bolivian Highway Administration (ABC) bribery scandal over the awarding of construction contracts to China Harbour Engineering Company Ltd., (see TCS September 9), the Bolivian Government announced that all contracts signed by CHEC will be investigated.

Local NGO Fundación Milenio’s "El capital corrosivo" investigation states that CHEC has been unfairly awarded $3.5 billion of contracts in the country. CHEC has yet to make a statement on the matter, according to Bolivia’s Minister of Justice, Iván Lima. (RP)

See TCS April 8 for further background on CHEC. You can read Fundación Milenio’s full report, in Spanish, here.

Ecuador 🇪🇨

~ Paraphrased translation from Spanish ~

The Ecuadorian Prosecutor's Office raided an office of the Chinese firm Synohidro on Wednesday (7 September) as part of an investigation into the alleged crime of bribery against former President Lenín Moreno (2017-2021), also involved in a corruption case known as "Ina Papers".

In its Twitter account, the entity indicated that it raided the offices of Sinohydro, a company that participated in the development of the Coca Codo-Sinclaire hydroelectric plant, the largest in the country.

The Prosecutor's Office, at the request of Moreno himself, investigated his accounts when he was a special envoy of the United Nations Secretary General for Disability, between 2013 and 2016.

The former president has accepted accounts at Banco Post Finance, opened when he was a special envoy to the United Nations, and another personal account at UBS in Switzerland, but has denied being the owner of the company "Ina Investment", of Banco Balboa in Panama.

His political opponents have warned that this company could contain funds from alleged acts of corruption involving people close to Moreno.

However, the former president categorically denies the allegations, and argues that his political rival and former president Rafael Correa (2007-2017) is targeting him. Correa has been convicted for corruption and currently resides in Belgium. (RP)

Unfair Competition 🧐

Peru 🇵🇪

~ Paraphrased translation from Spanish ~

On Monday 12 September, the Peruvian government, through the National Institute for the Defense of Competition and Protection of Intellectual Property (INDECOPI), decided to extend pre-existing anti-dumping duties on footwear imports from China until November 30, 2026.

…INDECOPI pointed out that "the analysis of the main economic and financial indicators of the national Peruvian industry showed signs of deterioration with respect to the positive trend registered by Chinese footwear imports to the country". (RP)

Energy 🔋

Argentina 🇦🇷

Months after an announcement that China will build and largely finance an US$8-billion nuclear power plant outside Buenos Aires, the deal is hung up over Argentina’s demand that its engineers be permitted to manufacture the reactor fuel domestically.

Becoming the first nation licensed to make fuel for China’s Hualong One reactor would greatly advance Argentina’s atomic programme. It would also signal that China is willing to licence technology to trading partners, following a commercial pathway blazed by US nuclear manufacturers.

Nuclear fuel differs from gas and coal because it requires precision-engineered assemblies that conform to safety requirements. Sharing the technology with other countries could cement China’s growing role in nuclear markets, said Mark Hibbs at the Carnegie Endowment for International Peace.

“Beijing will obtain strategic leverage where Chinese nuclear firms do business,” said the Berlin-based analyst. “Chinese success in exporting nuclear equipment, technology and materials will open the road for China to replicate the success of the US in spreading its influence into the foreign, energy, and technology policies of China’s nuclear partners and clients.”

The growing nuclear cooperation between Beijing and Buenos Aires, which follows billions of dollars worth of Chinese investment in Argentine infrastructure, is raising alarm bells in Washington. Argentine media reported that US State Department officials warned counterparts at an April meeting in Buenos Aires that the Hualong One’s safety systems may not meet international safety standards.

Agriculture 🌾

Argentina 🇦🇷

Argentina's Bioceres expands global seed tie-up with Syngenta - Yahoo Finance - September 16, 2022

Argentine seed technology firm Bioceres said on Friday it had agreed to expand its collaboration with Swiss seeds and pesticides maker Syngenta to develop and market its biological seed treatment solutions globally.

The deal between the two firms, which already partner in Argentina, would see Syngenta become the exclusive commercial distributor of these products globally and work on research and development of new products with Bioceres.

Bioceres develops biological products that help improve crop nutrition and cut down the need for nitrogen fertilizers. It also has a range of drought-resistant crops, though they will not be part of the deal.

Syngenta, which is planning a $10 billion initial public offering, was bought in 2017 for $43 billion by ChemChina, which was folded into Sinochem Holdings Corp last year.

Bioceres said the two firms would expand their cooperation in markets such as Brazil and China, as well as other regions around the world.

Bilateral Relations 🤝

Mexico-China 🇲🇽🇨🇳

The Evolution of PRC Engagement in Mexico - Diálogo Américas - September 20, 2022

Despite the interest of individual Mexican businesspersons and politicians in profiting from Chinese investment and exports to the Chinese market, Mexico’s overall embrace of the PRC has been limited—mainly due to its integration with the U.S. through the North American Free Trade Agreement (NAFTA), and its close security relationship under the governments of Felipe Calderon and Enrique Pena Nieto. Mexico is currently one of a small group of countries in the Hemisphere that has not signed onto the 2013 PRC “Belt and Road” initiative.

Mexican experts consulted for this work also argue that the relationship was limited by structural competition between Chinese and Mexican industries, such as manufacturing, as well as distrust of the PRC within certain parts of Mexico’s business elite and society. There have also been difficulties within both Mexico’s business community and the Mexican government in understanding and promoting the nation’s interest toward China.

Although Mexico has continued its contradictory posture toward the PRC under the government of President Andres Manuel Lopez Obrador (AMLO), multiple factors have combined to bolster the importance of the PRC for the AMLO government. On one hand, its focus on state-led growth—including its prioritization of a state role in the petroleum, electricity, and mining sectors—have decreased the interest of market-oriented players in Mexico in those sectors. As a result, Chinese loans, tied to work by PRC-based companies, have remained as one of the few remaining options. Indeed, PRC-based companies play a key role in AMLO’s signature infrastructure project, the Maya train, as well as in the lithium, petroleum, electricity, and manufacturing sectors, as discussed in subsequent sections. At the same time, the expanded vulnerability of Mexicans due to the lingering economic effects of COVID-19, the inflationary effects of Russia’s invasion of Ukraine, and lackluster prospects for Mexican GDP growth increase the importance of Chinese demand for Mexican products in sectors such as pork and tequila, where they make such purchases.

America’s China Challenge in Mexico - The Hamiltonian - September 12, 2022

Two PRC state-owned enterprises—China Communications Construction Corporation (CCCC) and CRRC Group—recently won contracts totaling $2.7 billion for Mexican public transit construction projects. In April 2020, a consortium led by Portuguese construction conglomerate Mota-Engil and CCCC won the contract for the first section of the Tren Maya (Maya Train).[37] Conceived by AMLO as an economic development project to link tourist destinations in the Yucatán Peninsula, the rail project is expected to cost more than $8 billion and has faced pushback because of its cost as well as environmental concerns.[38] In Mexico City, a subsidiary of CRRC Group won a $1.9 billion contract to modernize the city’s Metro Line No. 1.[39]

Since 2011, Huawei has won at least four major contacts with Mexican cellular providers, including the Red Compartida tender, and the company claimed in 2019 that it ran more than half of the 4G network hardware in the country.[54] This existing market presence and relationship with the Mexican government created obstacles for U.S. diplomatic arguments about Huawei’s security and reliability. Huawei’s reach in Mexico is also broader than cellular data networks. The company partnered with the government to build more than 30,000 public WiFi hotspots across the country.[55] Additionally, Huawei’s cloud services arm already operates one data center in Mexico and announced plans to open a second as part of the company’s push to gain market share in Latin America.[56]

Natural Resources 🪨

Peru 🇵🇪

Chinese miner MMG Ltd expects to invest $2 billion in the next five years to expand its troubled Las Bambas copper mine in Peru and is eyeing potential acquisitions to further increase production, Las Bambas’ General Manager, Edgardo Orderique, said on Tuesday 27 September.

The company is hoping to double copper production by 2025 and double it again by 2030… The mine is expected to produce 240,000 tonnes of copper in 2022, after years of production drops due to falling ore grades and social conflicts.

…Las Bambas is currently trying to build a second pit but work has been halted due to opposition from the indigenous Huancuire community, which used to own the land where the project is slated to be built.

See TCS April 4 (including our background on MMG Ltd.), and TCS April 23 for further Las Bambas mine coverage. (RP)