The China Signal - September 7

CNPC returns to Venezuela? Honduras' opposition to recognise Beijing, Brazil suspends beef exports to China

G’day, and welcome to The China Signal! This week, China National Petroleum Corp. takes preliminary steps to return to Venezuela, the Peruvian government beckons MMG and Southern Copper to help build a rail line from the Andes to the Pacific coast, Honduras’ leftist opposition party pledges to recognise Beijing over Taiwan should they win the national election in November, Brazil suspends beef exports to China over two mad cow disease cases, Uruguay joins the New Development Bank, Colombia’s media coverage of China is analysed, plus more. Read on.

Oil

Venezuela 🇻🇪

China’s Top Oil Producer Prepares to Revive Venezuela Operations - Bloomberg - September 1, 2021

China National Petroleum Corp. is sending engineers and commercial staff there and vetting local companies for maintenance work at an oil-blending facility it operates with Petroleos de Venezuela SA, according to people with direct knowledge of the firm’s actions, who asked not to be named because the information isn’t public. CNPC is also contacting local service providers to potentially boost crude output at five other ventures with the Venezuelan state producer, the people said.

While CNPC’s moves are still preliminary, they are the first signs that one of Venezuela’s most important international partners is considering returning to the country in earnest after two years of scant investment. The Chinese producer has yet to take key steps, such as signing procurement or service contracts with local firms.

CNPC was one of the largest foreign players in the country as recently as 2016, when it was producing about 170,000 barrels a day, according to PDVSA data. Its output had tumbled 75% as of July, after U.S. sanctions made it harder to do business in the country and PDVSA’s financing dried up.

Aiming to lure investment, Venezuela’s government-controlled National Assembly is drafting an energy law that would allow foreign companies to own a controlling stake in joint ventures they operate with PDVSA. The proposal has been met with some resistance, and it’s unclear when the bill will come up for a vote in the legislature.

Mining

Peru 🇵🇪

Peru wants mining companies to help build railway to Pacific coast - August 25, 2021

Peru is asking help from mining companies Las Bambas, of China's MMG Ltd , and Grupo Mexico's Southern Copper to build a rail system from a mineral-rich Andean zone to the country's central Pacific coast, Mining Minister Ivan Merino said in an interview.

Representatives of both companies said they were open to discussing participation in the railroad, which would be used to transport both commodities and people. Peru is already the world's No. 2 copper producer, and the country's new government want to further develop the sector.

The railway, in the technical evaluation stage and with construction scheduled to start in 2023, would start in Cusco or Apurimac and go to the port of Marcona, Merino told Reuters in an interview late on Tuesday.

Diplomacy

Ecuador 🇪🇨

China is willing to expand the scale of imports from Ecuador, further liberalize and facilitate bilateral trade and investment, and cultivate new growth points such as the building of a health Silk Road, a digital Silk Road and a green Silk Road, so as to achieve more results in bilateral practical cooperation and create more benefits for the two peoples.

Honduras 🇭🇳

Taiwan warns Honduras against 'flashy, false' China promises - France 24 - September 6, 2021

Taiwan warned Honduras on Monday against "flashy and false" promises by China after the Latin American nation's main opposition party vowed to switch diplomatic recognition to Beijing.

Honduran presidential candidate Xiomara Castro earlier said she would "immediately open diplomatic and commercial relations with mainland China" if she wins elections in November.

Castro, the wife of ousted former president Manuel Zelaya, is the candidate for the main left-wing opposition Liberty and Refoundation Party.

Honduras is among only 15 countries that maintain formal relations with Taiwan, which China claims as part of its territory awaiting reunification, by force if needed.

Agriculture

Brazil 🇧🇷

Brazil has suspended beef exports to China after confirming two cases of “atypical” mad cow disease in two separate domestic meat plants.

The halt to beef export begins immediately, the agriculture ministry said in a statement on Saturday, adding Beijing will decide when to begin importing again.

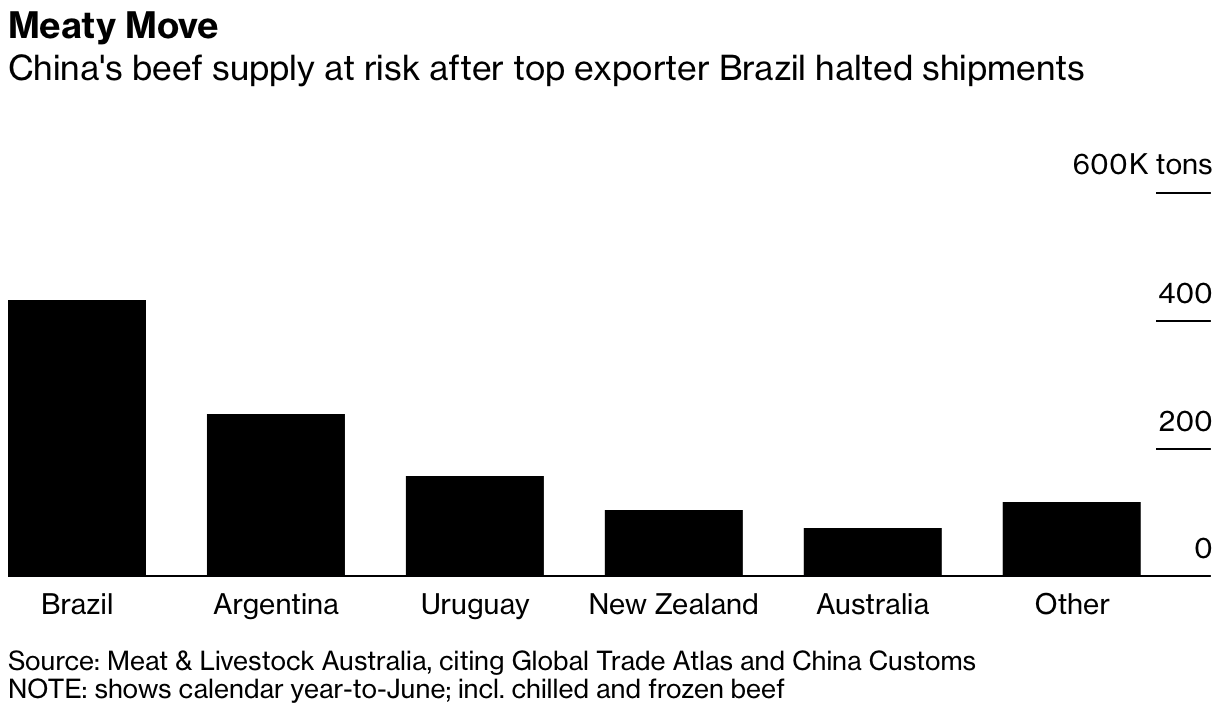

Brazil is the world’s largest exporter of beef, with China its biggest customer. More than half of Brazil’s beef export goes to China and Hong Kong.

China’s Limited Beef Options Imply Brazil Ban Will Be Brief - Bloomberg - September 5, 2021

The temporary suspension by Brazil comes as China’s two mainstay suppliers, Argentina and Australia, have seen reduced access into the world’s biggest imported beef market this year. Argentina is limiting beef exports until Oct. 31 to contain inflation, while Australian beef is subject to trade restrictions imposed by China amid frosty relations between the two countries.

This suggests the temporary ban on Brazilian beef exports is unlikely to be dragged out. The fact that the two cases of mad cow disease were “atypical” in nature also means the suspension will probably be a “short-term issue,” said Rabobank analyst Chenjun Pan. An atypical case is rare and happens spontaneously, as opposed to classical cases caused by contaminated feed.

New Development Bank

Uruguay 🇺🇾

BRICS development bank admits UAE, Bangladesh, Uruguay as new members | Reuters - September 2, 2021

The New Development Bank (NDB) set up by the BRICS group of nations said on Thursday it had admitted the United Arab Emirates, Uruguay and Bangladesh as members in its first expansion push.

Brazil, Russia, India, China and South Africa - a group of major emerging economies known as BRICS - launched the bank in 2015 and started formal talks with potential new members last year.

Since launch, the Shanghai-headquartered lender has signed off some 80 projects worth $30 billion in all of its five member countries stretching across sectors from transport, water and sanitation to clean energy or digital and social infrastructure.

Investment

Colombia 🇨🇴

Notably, there has been a significant increase in investment and the participation of Chinese companies in Colombia through Public-Private Partnerships (PPPs), which represents a significant shift in dynamics.

However, in the current national context, two factors could affect the further proliferation of PPPs. Firstly, the devaluation of the peso against the dollar increases the cost of projects. Secondly, the Colombian state has limited capacity to cover additional expenses. This is due to the increase in borrowing costs and limited access to financial markets as a result of the fiscal deficit that led to the downgrading of Colombia’s investment rating by agencies such as Standard & Poor's (S&P), from BBB-to BB+.

Prior to the current crisis, there was evidence of a proliferation of PPPs with Chinese companies in activities that fall into three categories: Large infrastructure projects; clean energy generation; and tenders for the sale of electric vehicles.

I reviewed 60 articles published between 2006 and 2021 that refer to new projects (Greenfield) and investments in existing projects (Brownfield). In many cases, the investment flows come from Chinese firms with subsidiaries in other countries, which prevents them from being included in the data. As a result, investment figures could be even higher.

The data reveal that 67% of the articles analysed present a favourable view of infrastructure and renewable energy projects, followed by 18% neutral views. Articles with a negative reading accounted for 15%.

In particular, [those articles with favourable views] tend to advance a narrative of job creation and economic benefits that these projects are expected to generate. In many cases, information seems to replicate company or government press releases.

The negative perceptions are more diverse, arising from three main issues: Firstly, the impact of projects on the environment and non-compliance with environmental standards; Secondly, Human rights violations and violations of indigenous and peasant communities’ rights. These first two are expressed mostly in opinion columns and non-traditional media; Finally the geopolitical dynamics of China's advance and the implications for Colombia’s relationship with the US. This set of articles also includes concerns about the involvement of these companies in strategic activities that could affect state sovereignty. Few articles address the relevance of the BRI for Colombia.